Did your employer make a mistake on your paycheck? Have you been shorted some money or do you have one of these other problems:

- Not enough tax withheld?

- Vacation time not correct?

- Overtime not correct?

- Hours missing?

It’s not fun finding a mistake on your paycheck. But with a little work, most of these types of problems can be overcome quickly.

We received this question from a Free Email Newsletter subscriber and thought you’d find it helpful.

TABLE OF CONTENTS

Question about IRS Paycheck Withholding Shortfall

My former employers did not take enough taxes out of my paycheck each time I was paid. Now, I owe the IRS money. Do I have any recourse with my employer?

MoneySmart Answer:

That is a frustrating situation and unfortunately, it happens too often.

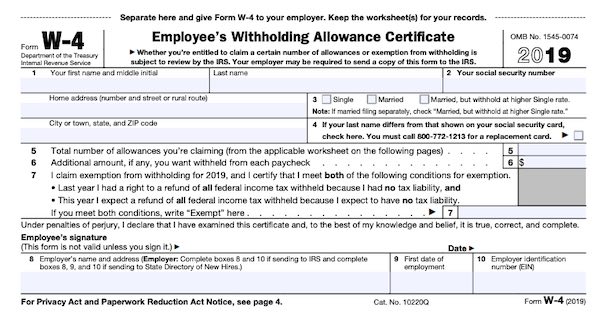

As much as we’d like to blame former employers, in the end, the IRS sees it as our responsibility to make sure that enough taxes are withheld from our paychecks. That is, of course, unless you filled out the IRS W-4 form and requested in writing to have more withheld from your paycheck.

Fill out your W-4 Correctly

The W-4 has a worksheet on it to help you determine how many “allowances” you should claim. These allowances could be dependents (children, parents who live with you, disabled spouse, etc), and calculations on deductions to income like mortgage interest.

The more allowances you claim on your W-4 the fewer taxes your employer needs to withhold. You can use the IRS Withholding Calculator here to help you estimate more accurately.

If you told your employer how much to withhold and they didn’t do it, you should appeal to them to pay the difference. But, you’d have to be able to prove that you submitted the information and they ignored it.

You’re Responsible For the Taxes

The bottom line is that we as workers/wage earners are responsible for monitoring and paying our taxes. As much as we’d like to blame someone else, in this case, we can’t.

So even if your former employer messed up the withholding, the IRS still requires that you pay the correct amount of taxes. So what can you do?

See if you can get through this without borrowing.

Do you have money in savings?

Could you work extra hours or an additional job until April 15 when the money is due?

Could you sell things on eBay or CraigsList to generate enough cash to make up for the mistake?

8 Things to Do About A Withholding Mistake

- Review Your Pay Stubs and W-4 Form:

- Verify the accuracy of the withholdings on your pay stubs against the W-4 form you submitted. The W-4 form determines the amount of taxes withheld from your paycheck.

- Contact Your Former Employer:

- Discuss the discrepancy with your former employer. It’s possible there was a misunderstanding or error in how your W-4 form was processed.

- Consult a Tax Professional:

- Seek advice from a tax advisor or accountant. They can provide guidance on how to address the shortfall with the IRS and possibly correct issues with your employer.

- Understand Employer Responsibilities:

- While employers are responsible for withholding taxes based on the information provided on your W-4 form, the ultimate responsibility for paying the correct amount of tax rests with the employee. This means recourse against the employer may be limited if they followed your W-4 instructions.

- Consider Adjusting Future Withholdings:

- To avoid future issues, adjust your withholdings with your current employer by submitting a new W-4 form. Use the IRS Withholding Estimator tool to help determine the correct amount.

- Explore Payment Plans with the IRS:

- If you owe taxes and cannot pay in full, the IRS offers payment plans. You can set up an installment agreement that allows you to pay over time.

- Legal Recourse:

- In cases of intentional misclassification or fraud by your employer, legal recourse may be an option. Consult with a labor attorney to explore your rights in this scenario.

- Document Your Efforts:

- Keep detailed records of all communications with your former employer and any steps you take to resolve the issue, as this documentation can be helpful if legal issues arise.

Ultimately, while employers must correctly process the information provided on W-4 forms, employees should regularly review their pay stubs and tax withholdings to ensure accuracy and avoid unexpected tax bills.

Other Employer Paycheck Mistakes

Over the years we’ve seen other mistakes on our paychecks. It’s MoneySmart to examine your paycheck carefully each time you are paid.

Withholding – as we said earlier this should be calculated and monitored with each paycheck. We do this to avoid owing money at the end of the year to the IRS

Work Hours – If you’re paid hourly, it’s good to check the number of hours. Did you possibly forget to submit hours? We’ve done that too. We’ve just gone back to the employer and submitted the corrected hours and received pay.

Overtime Missing – If you’re an hourly worker and get paid overtime it can be a big deal to not have it calculated properly.

Usually, you’ll be paid “time and a half” for any hours you work beyond a standard 40-hour workweek.

Some employers pay “double-time” for working on holidays.

If you know the overtime and holiday policies, always check your paycheck stub for accuracy.

Vacation Time – If one of your benefits is Paid Time Off or Vacation Time you’ll want to know the calculation for how many hours of vacation you get for every 40 hours of work you put in. If you think there’s a problem contact your Human Resources connection and work it out.

Tracking Your Hours

If you want to keep track separately from your employer’s time card system, you could simply create a Google Sheet and write your hours down for each day you work.

There are many free time tracking apps that you could use also. Check out this article from DeskTime.com where they describe 16 different apps.

RELATED ARTICLE: Sites Like Craigslist

Options When You Owe Taxes

If you owe a huge amount, perhaps you could have a knowledgeable friend or tax advisor help you draft a preemptive letter to the IRS to set up a meeting and work out a plan.

Working before the fees are due gives you much more negotiating power than waiting for them to come after you.

As for the future, sit down with someone in HR where you work or with a competent tax specialist or account and work out how many exemptions you should be claiming.

When it comes to your paycheck tax withholding, getting a small refund is the goal (somewhere in the $500 – $1200 range). Remember that a refund is not a gift, it’s money you earned that has been loaned to the Federal Government, tax-free for several months.

On the other hand, you don’t want to cut your exemptions so close that you end up owing money again. So do your planning and watch the amount withheld.

RELATED ARTICLE: Places That Will Cash a Personal Check

Taxes for Independent Contractor Work

If you choose to work a 2nd job or do some free-lance work where you’re paid as an independent contractor, please make sure you set aside at least 25 to 35 percent of that money to be paid in taxes.

If you earn more than $600 per year, the company should give you a 1099 form that summarizes your earnings.

As a self-employed worker, you’ll need to pay the full 15.3 percent in Social Security and Medicare Taxes. Plus you’ll also be responsible for paying income tax.

As a paid employee earning wages, your employer normally will pay half of Social Security and Medicare taxes and you’ll pay the other half, but as a self-employed person, you’re responsible for the full amount, in addition to any income tax you may owe. You shouldn’t have any trouble finding some free income tax calculators online. TurboTax has several free tax calculators and tools that you can check out here.

We aren’t accountants or tax experts, so please confirm all of this information with someone who is up to date with the current laws.

One thing we are experts on is utilizing a budgeting system to manage your money and build savings. This would be a perfect time to start using a money management system to get you through this financial squeeze, and then afterward use it to build your financial future.

Conclusion Paycheck Mistake

Unfortunately, paycheck problems will happen occasionally. And more, unfortunate, is the fact that if you don’t catch the problem, you’ll end up losing money.

If you develop a habit of checking your paycheck and keeping accurate records you’ll sail through any paycheck mistakes that come your way.