The price of groceries is constantly changing. But how do you survive when grocery inflation drives the price of groceries in your area through the roof? Or how do you adjust when you have changes in your family size?

TABLE OF CONTENTS

- 1 A Reader Asks about Grocery Inflation and Our Grocery Budget

- 2 How Inflated Grocery Prices have Changed our Grocery Budget

- 3 Grocery Inflation Chart 2022

- 4 What Hasn’t Changed with Our Grocery Expenses

- 5 What is ShrinkFlation and How to Spot It?

- 6 What You Can Do About Grocery Price Inflation

- 7 Our Grocery Goal

A Reader Asks about Grocery Inflation and Our Grocery Budget

I have all three of your books, and in your grocery book, you said that your grocery budget was around $350 per month. But as I’ve listened to interviews and your videos on YouTube, I have heard you say that your monthly grocery budget increased. Would you mind detailing some of these changes in your budget?

~ Leigh from Burlington, NC

How Inflated Grocery Prices have Changed our Grocery Budget

When we walk into the grocery store these days, we’re hit by Grocery Sticker Shock! It’s hard to believe how expensive grocery prices have become.

Our grocery budget for many years when all five kids were at home was $350 per month. With food prices increasing and five adults in the house, our budget had to change a little. We increased it by about 11% between 2004 and 2014. Keep reading to see what our food budget is today.

Everyone was welcome at our table as long as we had advance notice! The increase in our grocery budget also occurred because most of the other items in the grocery store have increased by 10 to 30 percent over the past few years.

And those things that have stayed the same price have been put into smaller packages — ice cream for example. This is a “sneaky” way for manufacturers to raise the cost of groceries without increasing the sticker price – this is now being called “shrinkflation.” We’ll go into more details later in this article

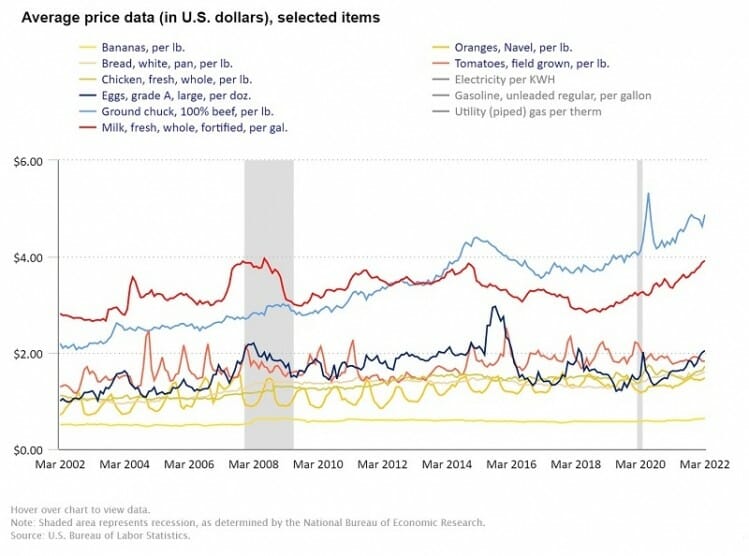

Grocery Inflation Chart 2022

This 2022 chart from Foodnavigator-usa.com and the Bureau of Labor Statistics shows how grocery prices have increased.

Our Current Grocery Budget

In 2016, our last child left the nest, and we scaled back our food budget. We reduced our budget to $300 per month for groceries. Buying and cooking for just the two of us was definitely a change.

We still stock up on sale items and use our freezer to store the deals we get. Our new budget amount worked okay for a few years, but then in 2019, we started to increase it due to rising food prices.

And now historically high inflation, we’ve had to raise our grocery budget again. We are now spending about $400 per month on groceries.

But we’re also still feeding extra people with that budgeted amount. Between Airbnb guests, friends we have over for dinner, events we host, or kids and grandkids stopping by, we’re serving meals to larger groups of people 8 to 10 times each month.

What Hasn’t Changed with Our Grocery Expenses

What hasn’t changed is the way we manage money. We still use our budgeting system.

We save a pre-determined amount of money from each paycheck for specific “budget accounts” within one checking account. You can read more about the system in our first book, America’s Cheapest Family Gets You Right On The Money.

And you can learn how we use our freezer to take advantage of sales we find and how it keeps our food budget lower than most families.

How We’ve Changed Our Shopping Habits

When the kids were all home and we were running around between work and kids activities, we only shopped one time per month. As the kids have left home, we’ve changed our grocery shopping habits.

Our Shopping Frequency Has Changed

We’ve started doing an intermediate shopping trip (in the middle of the month) to supplement our “big shopping trip” at the end of each month. This change was precipitated by a decision to eat more fresh fruits and vegetables.

We haven’t changed stocking up on sale items and buying produce items that are in season.

Saving On Fresh Produce

Buying in-season produce is a great way to reduce what you spend on groceries. For example, when grapes are in season and on sale, they’ll cost around $.79 per pound in our area. When they’re not in season, they cost more than $2 per pound. Buying grapes on sale and in season saves 60 percent! That’s a huge saving!

Couponing Has Changed

Since grocery stores have stopped offering double coupons, we rarely use clipped paper coupons for groceries. Annette doesn’t always have the time to clip, sort, purge expired ones, and use them.

However, the grocery store loyalty cards and their associated digital coupons have given us great savings.

Annette reviews the ads and selects the sale items or bonuses she wants to use and adds them to our account.

It’s a little more difficult now to remember what she wants to pick up because she doesn’t have a physical coupon in hand to remind her.

But by using a shopping list with the items written on it and marking digital coupons with a “C” (for coupons) it works pretty well.

Coupling digital coupons with sale items and markdowns can still save you money on groceries

Stocking Up on Deals

We’re still stocking up on storable/freezable food when it hits a rock bottom price. Recently cherries were 99¢ a pound here and we bought about 10 pounds, de-pitted them, and froze them.

We also found a killer deal on Top Round for $1.33 per pound – bulk cut – and we bought about 40 pounds of it.

What is ShrinkFlation and How to Spot It?

Shrinkflation is a term attributed to Pippa Malmgren an economist and advisor to former President George W. Bush. In 2015 she was quoted in an article that appeared in Personal Finance Hub (PFHub.com).

The trend in the marketplace has been for companies to charge more for less. This would be the very first step towards rapid spikes in prices.

Pippa Malmgren – Economist

In 2015 Pippa pointed to these products that manufacturers had made smaller while keeping the prices the same.

- Cadbury removed two squares of chocolate from it’s candy bar but kept the price the same.

- Nestles Shredded Wheat boxes shrunk 55 grams, but the price didn’t change.

Shrinkflation in 2024

More recent Shrinkflation has been spotted by other reporters. BusinessInsider cites these 16 products that cost more because of reductions in size.

- Ice Cream. Several manufacturers have reduced the standard 1.75-quart-sized package to 1.5 quarts.

- Walmart Great Value Paper Towels dropped from 168 sheets per roll to only 120, while the price stayed the same.

- Frito-Lay just shrunk regular bags of Dorito’s from 9.75 ounces to 9.25 ounces. Both are currently for sale at Target for the same price.

- Hershey cut down its 18-ounce pack of dark chocolate Kisses by almost two ounces.

- Hefty’s mega pack went from 90 bags to 80 bags, at the same price.

- A two-pack of Reese’s Peanut Butter Cups used to weigh 1.6 ounces. Now it’s just 1.5 ounces.

- Tillamook decreased the size of its ice-cream cartons from 56 ounces to 48 ounces. It said that it didn’t make the decision lightly, but that if it didn’t make it cartons smaller it would have had to hike up prices because of rising ingredients costs.

- General Mills shrunk its “family size” boxes from 19.3 ounces to 18.1 ounces – a drop of nearly 10%.

- Quaker Life cereal also shrunk from 24.8 oz to 22.3, and it was renamed from “Giant” to “family” size.

- Cottonelle’s Ulta Clean Care toilet paper is down to 312 sheets from 340.

- Bounty Triples reduced the sheet count from 165 sheets to 147. Proctor and Gamble told Quartz that it’s still a better deal than before because the sheets got more absorbent.

- Crest shrunk 3D White Radiant Mint toothpaste from. 4.1 oz to 3.8 oz, about one tooth brushing’s worth.

- Wheat Thins changed its family size from 16 oz to 14 oz, with about 28 fewer crackers per box.

- Gatorade redesigned its 32 oz bottle to be “more aerodynamic and it’s easier to grab,” a representative told Quartz. The new design holds 28 oz.

- Chobani minimized its Flips yogurt from 5.3 ounces to 4.5 ounces.

- Huggies Little Snugglers packs dropped from 96 diapers per box to 84.

- Pantene has rebranded its Curl Protection Conditioner and in the process reduced the size from 12 to 10.4 ounces,

What You Can Do About Grocery Price Inflation

Check the shelf tag for the per-unit price. This will help you quickly see the difference in price between competing brands.

Compare other brands – not every manufacturer has shrunk their packaging – look high and low on the shelves and compare.

Write the Company. If enough consumers complain about shrinking sizes manufacturers may change.

Ask for Coupons. Write the manufacturer and compliment them on the quality of their product, but let them know that their price increases are making it more difficult for you to continue to buy their product. Ask them if they could send you several coupons to help out.

Track Prices. Write down the prices of some of the most common items you purchase. When you see a sale price, stock up on several months’ worth.

Buy Bulk. Of course, this should only be done if you can use the items before they go bad. Also, check your prices, not all bulk food items are less expensive than grocery store sale prices.

Our Grocery Goal

Our goal is to live within our means. And methods for doing it have remained the same over the years. We’ve adjusted our food budget and our shopping strategies to deal with higher grocery prices.

Inflation is a real problem, but not insurmountable. You’ll need to be a more careful and aware consumer to save money on groceries.

But honestly, there are still so many options for reducing what we spend on groceries that we can survive grocery price increases without stressing.

If you want to track grocery prices for specific items get our Grocery Price Tracker here.

What grocery prices have left you with sticker shock?

Hi if you have school age kids, someone told me that if you text FOOD 877877 they will send you a message back for locations in your area where meals are given Free to children! Have not tried it but a teacher told me. just passing it on..If you are having trouble buying groceries as many are, give it a try….,maybe Steve can post this in his next newsletter?

Rich