What does living below your means . . . mean? Does it mean a life of deprivation? Does it mean a life of constant coupon clipping, or a life of regularly saying, “We can’t afford it?”

TABLE OF CONTENTS

- 1 Living below your means – something different.

- 2 Frugal Pro Athlete #1 – NFL Player Ryan Broyles

- 3 Frugal Pro Athlete #2 – MLB player Daniel Norris

- 4 What does living below your means . . . mean?

- 5 How to Set up a Budget to Help you Live Frugally

- 6 Living Below Your Means: Questions to Ponder:

- 7 Living Like a Frugal Pro Athlete With a Budgeting System.

Living below your means – something different.

- Maybe it’s saying yes to your top priorities like paying off debt and building savings/retirement.

- OR, it’s saying, “I’d love to take a cruise, but this year we only have enough money for a driving vacation.” And then making it a fantastic, fun family memory.

- Maybe it’s saying, “I’m making great money right now, but this may not last, so we’re going to live smaller and save bigger.”

Living below their means is exactly what these two young superstar professional athletes are doing:

Frugal Pro Athlete #1 – NFL Player Ryan Broyles

This young man realized that his earning power as an NFL player could be cut off at almost any time. Being a good steward, he has committed to living a “normal” life at $60,000 a year instead of the luxurious life he could “afford.” It’s MoneySmart. Get more information from the ABC News story here.

Learn more about Ryan (Wikipedia) and what he’s doing now that he is retired from the NFL.

RELATED ARTICLES:

– How Frugal Living Helps You Retire Early

– Best Retirement Gifts: Frugal, Fun & Decadent

Frugal Pro Athlete #2 – MLB player Daniel Norris

MLB rookie Daniel Norris lived in a VW van during spring training, behind a Walmart, just to keep life simple and focused. He was originally signed by the Toronto Blue Jays but was later traded to the Detroit Tigers. He’s playing this year and recently pitched in a game against the Anaheim Angels in May 2017.

This quote from an ESPN article sums up his financial philosophy:

On the morning in 2011 when his $2 million signing bonus finally cleared, Norris was in Florida with the rest of the Blue Jays’ new signees. All of their bonuses had been deposited on the same day, and one of the players suggested they drive to a Tampa mall. They shopped for three hours, and by the time the spree finally ended they could barely fit their haul back into the car. Most players had spent $10,000 or more on laptops, jewelry and headphones. Norris returned with only a henley T-shirt from Converse, bought on sale for $14.

You can read more in these articles: ESPN Article and here.

Get up-to-date information on Daniel Morris’ career on Wikipedia.

Are these two athletes being stupid or smart?

We believe that knowing the statistics and living well below their means is a great way to stay grounded in reality. Even if you’re not earning millions you can still learn how to manage your spending and earning so that you have an excess. That’s what we’ve done for years and years.

“Wealth is attracted

to those who actively manage it!”

~ Steve Economides – MoneysmartFamily.com

What does living below your means . . . mean?

It starts with knowing what it costs you to live. If you don’t have a good handle on your real living expenses how can you possibly live below them?

We use a worksheet to figure out what a family is realistically spending each month. We call it our Income/Outgo Worksheet.

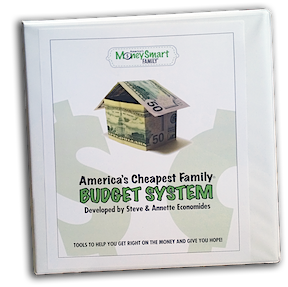

This worksheet asks every question you could think of for monthly household expenses and is included in our America’s Cheapest Family Budget System.

How to Set up a Budget to Help you Live Frugally

Following is how we set up our budgeting system.

List Monthly Income Sources Including:

- Regular Earnings

- Rents

- Freelance Work

- Child Support

- Side Hustles

List Monthly Expenses Including:

- Housing: Utilities and Maintenance

- Food

- Auto Expenses: Gas, Payments, Maintenance, Insurance, and Registration

- Utilities: Gas, Electric, Water, Trash, Cell Phone, Land Line Phone

- Charitable Giving

- Insurance: Medical, Dental, Optical, Life

- Debts: Credit Cards, Student Loans, anything else owed

- Savings

- Recreation: Eating Out, Baby Sitters, Activities, Cable TV, Internet

- Clothing

- Gifts: Christmas, Birthdays, Baby/Wedding Showers

- Misc: Barber, Beauty Shop, Cleaners, Allowances, Lu ches

- Kids Expenses: Allowances, Tuition, Daycare, Clubs

- Vacation

- Pets: Food, Vet Care, License

Getting all of your expenses written down and calculated on a monthly basis is a great exercise. The next step is taking your income and calculating if your monthly paychecks can cover all of the categories including some savings from each paycheck.

If you can, then set up your budget. But if you can’t you’ll need to start evaluating those variable expenses and finding ways to save until your expenses are smaller than your income.

But having a one-sheet income/outgo worksheet isn’t a budget, but it is a start.

Next, you’ll need a system that you can use on a regular basis (2 times each month) to manage your expenses and your income. The nice thing is that this system doesn’t have to be too complicated to be effective.

A Simple Way to Manage Expenses

By having a simple money management system and actively working with it for about 4 hours each month, we have accomplished some amazing milestones on a lower than average income.

- Paid off first home in 9 years (average income $35,000)

- Paid cash for all of our cars

- Remodeled two kitchens for cash

- Took fun-filled family vacations

- Sent our kids to college without student loans

- Re-landscaped our now beautiful backyard.

Living Below Your Means: Questions to Ponder:

What could you accomplish if you knew that your money was going to be spent when and where YOU wanted it to be spent?

How would you feel if you knew that ALL of your living expenses were covered each month (including saving for Christmas and Birthday presents)?

What would you be saving for, if you knew that by managing your income and spending, you could without a doubt, reach that goal?

It’s taken us about 2 years to fine-tune the instructions and tools that we’ve created for our America’s Cheapest Family Budget System.

This is the EXACT system we’ve used for the past 35 years. And in the past year, HUNDREDS of families have started using this family-friendly, “low-tech” system to manage their money.

This video explains several different ways to manage your money:

Living Like a Frugal Pro Athlete With a Budgeting System.

Our budget system is simple. It’s not computerized. But it is designed for couples to work on together, wherever and whenever they have time.

And it’s super-portable. We “Do the Budget” on the 1st and the 15th of each month. It takes about 2 hours each time, and we usually do it together. Because of this, we’re always on the same page financially.

You can read more about the system and what it includes, along with some comments from people who have used it.

Many who have used this budget system say that they feel so “in control” that they could never imagine going back to living the way they did before!

How about you: Is it time to become a Major League money manager?

Our family may be living below our means . . . but that means we’re living above average!

If you’re interested in more information on budgeting, read our 4-part Budget Blog Series listed below:

1) Overcoming Budget Obstacles

2) How to make the Best Budgets for Savvy Spending

3) The Amazing Key to the Most Powerful Household Budget Ever!