Top Kids & Money Articles

Popular Saving Money with Kids Articles

Kids & Money Resources & Award-Winning Book

who are financially strong.

The MoneySmart Family System

Teaching Financial Independence to Children of Every Age!

NY Times best-selling authors Steve and Annette Economides raised five kids and spent 77 percent less than the USDA estimated. And the money they did spend was also used to train their children to become financially independent.

The MoneySmart Family

System will help you teach your children to manage money and have a good attitude while they’re learning to earn, budget and spend wisely.

MoneySmart Kids Payday System

Financial Training Kit

Get our tested Payday System for your kids. Join thousands of other parents who have decided to train their children to become financially independent.

The MoneySmart Kids Financial Training system teaches money management skills while encouraging good attitudes about chores and school.

MoneySmart Kids Extra Envelopes

for the MoneySmart

Kids Kit

Get additional sets of indestructible envelopes. These envelopes are needed when you have more than one child who wants to use the MoneySmart Kids Financial Training Kit.

Or use these extra envelope sets as your children mature and add more categories to their personalized budget. Sold in sets of three.

Free Stuff for Your Kids & You

Raising Money Smart Kids Who Grow Financially Strong

Parenting Insights from Authors Steve & Annette Economides

on how to Raise Money Smart Kids

Why worry about the topic of Money Smart Kids?

We understand that raising money-smart kids can feel overwhelming for several reasons.

One, many parents don’t feel like they are managing their own money in a great way, so how can they possibly be teaching their kids about it.

Two, when you talk about kids and money, it overlaps so many parenting habits that many folks don’t like their parenting messed with. It’s so hard to change the patterns that we ourselves grew up with.

Three, the whole smart money smart kids topic messes with my parental idea of loving my kids.

Isn’t it loving our kids to give them the things we didn’t have growing up, or to give them the things their friends have, so they won’t feel left out or ostracized by their friends?

We answer all these questions in our third book, The MoneySmart Family System:

Teaching Financial Independence to Children of Every Age.

What is the 5/50/500 Rule and why is it important?

The 5/50/500 money rule describes the escalating cost of a lesson that goes unlearned. Every age and stage of a child’s growth comes with expectations.

If parents don’t learn how to train their children to stand financially independent at the $5 stage of life, they will be destined to fund an unending stream of $5 child demanded items until the price escalates to $50, then $500, and then $5000.

The MoneySmart Family System teaches parents how to stop the consequences of the 5/50/500 rule. And how to raise money-smart kids.

What is The MoneySmart Family System?

The MoneySmart Family System is an award-winning book describing how we used our MoneySmart Kids Financial Training System to train our five kids to be financially responsible and independent.

We taught them to build financial muscles and to pull their own weight.

We start at a young age, teaching them to earn, save, and spend their own money. At age 11 they start buying their own clothes.

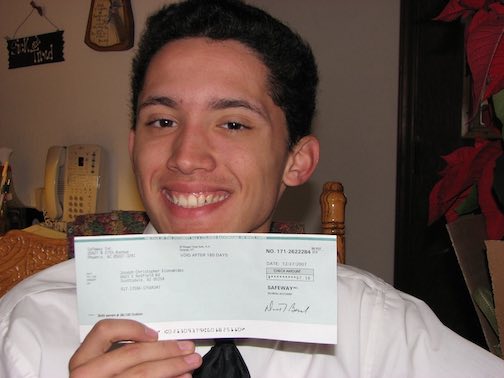

Eventually, these financially strong kids buy Christmas gifts for others, pay for their own auto insurance, pay cash for their own cars, and fund much of their own college educations.

When the kids are just starting out they earn a small amount of money from us and are responsible for managing it so that they can buy the things they need and want.

Eventually, they get a part-time job and learn to manage even greater amounts of money.

Because of our Money Smart Kids system, when they leave home, they have a practical working knowledge of personal finances and can survive in the real world, debt-free, and without bailouts from us. Smart Money Smart Kids are easier to raise than you think!

Why do you think chores are an important part of childhood?

Chores are the gateway to a productive adulthood. Starting at three years old, children can help with tasks around the house and those tasks can be used to teach them real-world working principles of diligence, timeliness, thoroughness and following instructions. Chores prepare a youngster to live independently and to grow to be smart money-smart kids.

How do you teach your children to be grateful and generous?

Gratefulness comes as a result of having a desire fulfilled after waiting for it—basically delayed gratification satisfied.

When children are indulged with lots of material possessions and never feel a need for anything, or never have the chance to earn their own possession, they are cheated out of learning gratitude and basically become “spoiled brats.”

We allowed our kids to wait for good things and helped them express their gratitude through writing thank you notes.

Why allowances don’t work for money-smart kids.

Allowances don’t work for the same reason that government entitlement programs don’t work. Paying someone for doing nothing produces . . . nothing. Many parents spend gobs of money on their kids or repeatedly give them a cash allowance to spend.

This is not what we would consider “money smart.” It’s so much better and more rewarding to our kids to allow them to earn the money from you and then learn to manage it — that is smart money-smart kids. They’ll develop a sense of pride and self-sufficiency, instead of a sense of entitlement and selfishness.

At what age do your kids start buying their own clothes and why?

In The MoneySmart Family System, initially, our kids are responsible for dividing up any money they earn into three categories: Giving, Saving, and Spending.

Between the ages of 9 and 11, we give them a raise and the additional responsibility of purchasing all of their own clothing. It’s a real-world responsibility and they love shouldering it and wearing it.

How much does it cost to raise Money Smart Kids?

The USDA calculates that it will cost the average parent $261,000 to raise a child from infancy to the age of 17. We calculated that it cost us 77 percent less than the USDA experts predicted.

We spent $1 million less raising our 5 Money Smart kids than the USDA predicted.

What miscellaneous expenses should children be responsible for?

As kids grow, their “wanters” are programmed to crave the latest and greatest of everything—things like trendy toys, extreme recreational activities, the latest techno-devices, costly cosmetics, and sporty sunglasses.

When our kids use their own money to make discretionary purchases they have a deeper sense of appreciation and take much better care of the item.

Why do you think that every teen ought to work a part-time job?

Every adult has to juggle numerous roles; employee, boss, parent, spouse, child, etc.

Allowing our teens to think that living at home while going to school is their only job is totally unrealistic. Learning to balance the priorities of work, school, extracurricular activities, and relationships are all things a maturing young adult must be taught to manage.

Allowing our kids to start this learning process while they’re still at home is much more beneficial than simply pushing them out of the nest and expecting them to fly.

Why shouldn’t you buy your child a car?

Parents shouldn’t buy their kids cars because it robs them of the opportunity to set, save, and reach a monumental goal on their own.

Financial independence is a muscle that needs to be strengthened one dollar and one goal at a time. For our kids, as they matured and grew more capable in their money handling skills, buying a car was a natural outgrowth.

But, if you are determined to give your child a car, read how this dad of 12 kids did it. Every one of his kids received a car, but it was given in a very unusual and money-smart way!

Can kids earn a college education without debt?

Scholarships are plentiful and aren’t only for academic excellence. In the largest chapter of our MoneySmart Family System book, we share how we helped our kids build great high school resumes that enabled them to win lots of scholarship money and opened many university doors.

How should you respond to your adult children when they need help with a financial problem?

When adult children experience financial problems, parents must respond with practical ways to help them grow financially.

A cash bailout is like applying a band-aid to a broken leg—it simply doesn’t solve the problem. Families should be a safety net for their grown kids, but not a crutch.

We have an entire chapter in our third book devoted to this topic.

More Kids & Money Resources

For some great resources about having Money Smart Kids, check out our Pinterest board.

Check out this blog about Stopping Entitled Kids!

We just set this up yesterday for our 3 children! They are still learning the ropes and doing the work but forfeiting the point for complaining or arguing with siblings, but they are quickly learning. I have one child taking to this right away and already an extra point earned for helping another sibling without asking! I am really looking forward to watching them learn and feel good about teaching them how to budget!

This common sense system saved my sanity!! How do you teach kids to take care of things? By teaching them how to budget and buy their own items. I started making my kids buy everything sooner than what was suggested and now I have friends and family amazed at the responsibility the kids show after only a year and a half on the system!!! It is exactly what we needed and will have no regrets when my kids are grown about what they were taught!!

Lifesaver!!!!

Roxanne!!! Thanks for sharing your experience. Your kids sound fantastic . . . and so do you. It’s so cool to see our kids grow strong in financial responsibility – they start by making small purchases and over time their financial confidence, earning ability, saving and purchase amounts increase. We’ve marveled as our kids have grown at the way they evaluate purchases – they are so far ahead of where we were at their ages.