Top Budgeting Articles

Budgeting Tips from Around the World

Making Money Tips

& Ideas Page

Learn about profitable Side-Hustles and other ways to Earn Extra Money!

Budget Tools – NY Times Best Selling Book

America’s

Cheapest Family Gets You Right On the Money!

NY Times Best Seller &

#1 Amazon Best Seller

More than 140,000 families found this book to be the easiest-to-understand, personal finance & household budgeting book. Discover how to budget, get out of debt and get your whole family right on the money!

America’s

Cheapest Family

Budget

System

A perfect companion to our book America’s Cheapest Family Gets You Right On The Money. This is the exact household budget book system we’ve used to pay off our mortgages in record time. It will help you live debt-free!

Managing

Household

Finances

Audio Seminar

90-minute Audio Seminar

Recorded live, Steve & Annette share 1.5 hours of practical “how-to budget” & money-saving tips to help you find thousands of dollars. You’ll also receive a helpful budget worksheet and other guides (instant download .mp3 with .pdf).

Free Stuff – Stretch Your Budget Further

Get

Free Stickers

More than 100 companies will send you Free Stickers by mail or in person.

This is a great way to collect free stuff to give to your kids or friends as presents.

Free

Mileage Tracker

Tracking your gas mileage can save you hundreds of dollars every year. This tool helps maximize your car’s performance and also saves money! We keep it in our glove compartment & use it every time we fill up!

Budgeting Video Playlist from Our YouTube Channel

Budgeting FAQs

1. What Does a “Household Budget” Mean to You?

The word “Budget” is probably as misunderstood or misinterpreted as the word “Love.”

When someone says, “I’m on a budget,” they usually mean that they need to conserve cash and can’t afford to spend money for an item. It’s a noun and refers to either a mental list they have created in their heads or a physical list of expenses they have written down that constitute their budget.

When we say “budget” we’re referring to a verb, an action word, “We are budgeting our money.”

Our budget is a system that helps us set aside money each paycheck in predetermined categories for spending in the future.

This very budget helps us protect money for irregular expenses like clothes, car repair, holidays, annual homeowners insurance or semi-annual property taxes and vacation. At the same time, we are also accumulating money for monthly expenses like food, gas, and utilities.

2. What Are the Different Types of Budgets Available?

Most budget systems don’t include setting aside specific amounts of money in advance for anticipated expenses.

But our budget does, and we can spend with confidence, knowing that all of our financial bases are covered.

We describe our budgeting system in depth in our NY Times Best Selling book, “America’s Cheapest Family Gets You Right on the Money,” and also in our “America’s Cheapest Family Budget System Kit.”

Here are some of the more common questions we receive regarding the setup and operation of our household budgeting system.

With unemployment up and costs for everything from gas to milk at record highs, having a realistic budget to manage household finances is more important than ever. In this article, we’ll answer some of the more common questions we’ve received.

3. Does Your Budget Book System Use Cash or Paper Accounts?

It depends on how you do your budget. If you use cash envelopes, then you should divide the money and physically put it into various account envelopes.

Leave unspent money in its specific envelope. Each pay period, add a predetermined amount of cash to each envelope.

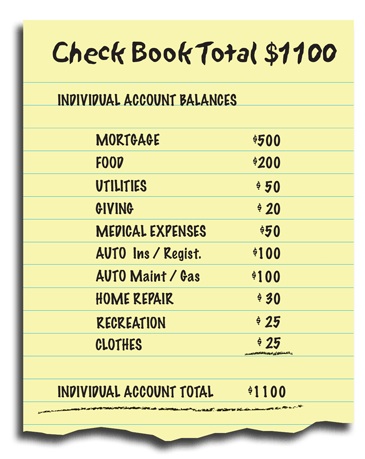

If you track funds on paper, keep the money in a checking account. The total of all your accounts should equal the checkbook total.

Here’s a simplified example (below):

Each pay period, you subtract expenses from their categories, then add your predetermined paycheck allocation. Again, the total should equal your checkbook balance.

4. How do you budget on a fluctuating income?

We’ve lived with a fluctuating income for many years. We base our budget on a low monthly average of our income. We tracked earnings over several years to arrive at this number.

In the months when our income is higher, we put the extra money into a budget category called “paycheck holding.” Then we can draw upon it during months when we don’t earn enough to fill our budget categories.

We keep several budget categories that we consider optional at the back end of our budget. If we have money, we fund them; if not, we don’t.

We’re also careful to not allow our “overhead” (monthly obligations) to creep up. If we want to purchase an expensive item, such as a car or new kitchen, we don’t finance it — which would increase our overhead with a monthly payment. We save for the item in advance, negotiate the best deal possible and pay cash.

On a fluctuating income, using a budget allows you to determine if you are free to spend the excess money you earn.

5. How Can I Lower My House Payment?

We have five kids. We don’t want to lose our house, but the payment is killing us and we’ve fallen behind. We’ve been told that our best bet is to file Chapter 13.

But then we would have to pay legal fees and resume our mortgage payment — which is substantial. Plus we would need to pay an additional amount each month to make up all the back payments.

Answer – Our hearts go out to you. We are not certified financial planners and don’t have financial degrees, but we have lived simply and frugally for a long time.

Your situation is a tough one. No house is worth the physical, emotional and marital stress you are probably experiencing.

Living with five kids limits your options, but children can survive on very little if their parents are unified and have time for them. We suggest reviewing your mortgage options with a sympathetic person at your bank or mortgage company.

Most lenders don’t want to have a repo on their hands. However, if we were in your shoes, we would sell the house and find the smallest housing option we could afford, even if that means renting. You can always look at renting as a temporary solution while you turn your finances around. What about becoming apartment managers or caretakers of a larger property? Look for creative options.

If any of your kids is 16 or older, he or she should have a part-time job, pay for his or her expenses and, if possible, contribute some to the family.

If you can sell the house and pay off what you owe, perhaps your credit rating won’t be affected as adversely as it would be with bankruptcy or foreclosure.

Sounds like you need to cut all unnecessary spending and prioritize your finances. One thing we can promise you, once you eliminate the weight of your crushing house payment and associated expenses, your financial burdens will feel much lighter and you’ll be able to enjoy the “little” that you really own.

6. How Did you Payoff Your Mortgage So Quickly?

I read about you in the Good Housekeeping magazine. Since I am a stay-at-home mom, saving money needs to be a high priority. There is one major question burning in my mind. How on earth do you pay off your house mortgage so quickly? Do you simply pay as much as you can each month?

Answer – You ask a very good question. Paying off a mortgage isn’t easy, but it is good. Because we have a very detailed budget/spending plan and we review it every two weeks, it helps keep us on track to reach our goals.

We keep our overhead low and don’t spend all that we earn. Living within our means has become a lifestyle and we enjoy the freedom it brings.

RELATED ARTICLE: How we paid our home off in 9 years

You have to be careful about “paying as much as you can.” It’s crucial that you set aside money for an emergency fund — at least $2000 — and savings. A budget is important in helping you decide how much extra you can afford to pay each month.

We started years ago by paying just an extra $2 toward the principal each month and it grew from there.

As you close in on the final few thousand dollars, you’ll reach a point where most other goals pale in light of finally hitting the milestone of being mortgage-free. It’s a great goal — go for it!

7. How Do I Budget on a Low Income with a Family of Four?

I understand that saving money is a state of mind, but I need to know how to do it on $20,000 per year and still support four people.

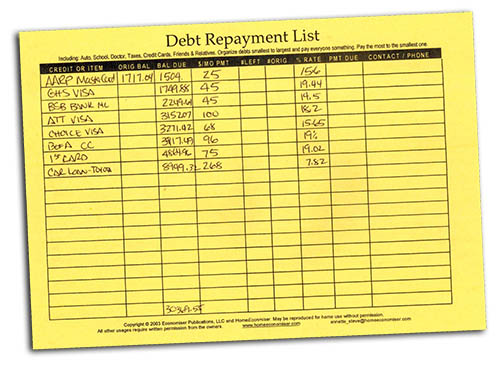

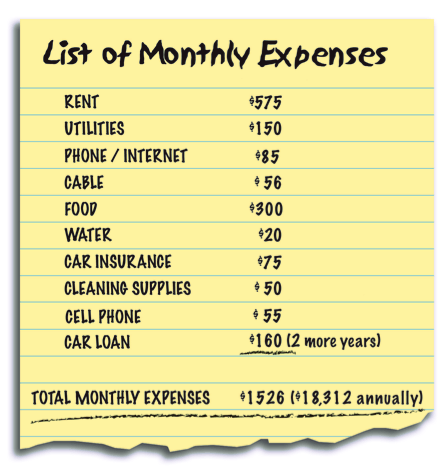

Here is a list of our expenses (image on the left):

Answer – We hear your desperation, and the answer is not an easy one. There are many steps to becoming financially free. Some require great sacrifice for a period of time. Often, when we give up things that we think we can’t live without, we realize that it’s only temporary and that living without them is not as hard as we thought it would be.

We have several recommendations. But they will only be partial answers because quite a bit of information is missing from what you have provided.

Are you a single mom?

How old are your children?

Is your cleaning supply expense higher because of cleaning houses for a living?

You make no mention of clothing money. If nothing else, each year underwear and socks have to be purchased.

What about recreation expenses? Are all of your family activities free?

Okay, now to evaluate your numbers:

Housing Your rent is probably reasonable for your area, but your total housing costs — rent, utilities, and water are eating up 50 percent of your income. Thirty-five to 40 percent is an acceptable level; you are in the danger zone. If you can negotiate a better price for rent, do it. If not, you must make the other expenses smaller or move to a new location.

Phone, internet, cable and cell phone are grabbing 13 percent of your income. You should be able to trim these expenses. Try losing your landline and researching different options for your cell phone – rates are always changing, we use T-Mobile and with 5 users on a family plan only pay about $28 per person for unlimited talk, text, and data.

The Internet is convenient, but spending a large percentage of your income for it isn’t. There are many less expensive options in your area. just do some research. You should be able to cut your phone and Internet costs in half.

Cable You may not like this, but lose the cable. It can be done; we’ve lived without it. Sure, our kids give us grief once in a while, but that’s tough, we’re paying the bills — and in truth, with the hundreds of movies and thousands of books in our personal home library, they lack very little. Our TV is used mostly as a monitor for videos. And remember that the public library is full of free videos and DVDs that you can borrow. If this suggestion is too radical, cut back to just having basic cable — but your bottom line has to be, “Will I feel better having cable or having savings in the bank.”

Food This category is below the national average, but by using a couple of hard-core economizer tactics, you could do better. Plan your meals based on what you find on sale in the weekly food ads. Get your whole family involved with the vision of saving dollars.

Savings When you get these other expenses under control, please be sure to implement a plan where you put some money into a savings account every time you get paid. You’ve got to live on less than what you make and build up an emergency fund to protect your family.

Any little steps you can take toward improving your family’s financial well-being will free up more than just money. Hang in there — any effort you make is a step in the right direction.

If You Have a Budget You’ll Love It

Any way you look at a budget if you make a commitment to regularly manage your money with a system that helps you save money in advance of expenses you’re going to LOVE the freedom and confidence you experience.

(How often have you seen the word Budget and Love in the same sentence?)