Are you coming into an inheritance in the near future? Or have you already inherited some money? Are you wondering what to do with inherited money?

We’ve been going through the process for the past few years and have learned a lot. We’ve also met with some incredibly wise and experienced estate and investment experts in the process. In this article, we’ve reached out to Attorney Lyle Soloman, the principal from Oak View Law Group in Rocklin, California.

How Inheritances Can Be Received

TABLE OF CONTENTS

There are several ways that most people receive an inheritance.

- You could inherit assets through a will

- You could benefit from intestate laws if someone dies without a will.

- You could also be the beneficiary of a financial account or an insurance policy

- You could be named as a beneficiary of a trust.

No matter how you receive a large inheritance, it usually signifies you have lost someone close to you.

With whatever method you gain financially, there are a few things to keep in mind before putting your newfound wealth to work for you.

Wills vs Trusts Statistics

- About 55 percent of people do not create a will to direct the handling of assets when they die. The Probate Court determines what is done with their assets.

- Of the 45 percent of people who do prepare a will, only 10 percent prepare a trust.

- A trust is a device that allows assets to be transferred without having to go through probate.

Reactions to Inheriting Money

The most common reactions to receiving an inheritance are sadness, anxiety, guilt, surprise, and followed by indecision.

When we have recently acquired a large sum of money, it isn’t easy to make appropriate decisions independently. This is one of the most typical reasons competent people are drawn into bad decisions when managing an inheritance.

Unfortunately, even educated individuals make mistakes from time to time.

If you’re facing an inheritance or a financial windfall read this article by Steve & Annette on how to deal with Financial Windfalls.

If you’re looking for smart ideas for what you can do with inherited money, keep reading. And later we’ll talk about some of the dumber things some people do with their inheritances and how you can avoid making the same mistakes.

6 Smart Things to do with Inherited Money

What should you do first? There are many wise points to consider when you begin to sort through the technicalities of receiving an inheritance.

1. Invest for The Future with a Carefully Planned Strategy

As a first step, consider these steps for how to invest an inheritance responsibly. Have you been given an inheritance and want to invest it?

As part of the process, you should consult with a financial counselor. These experts can assist you in developing a personalized and comprehensive financial management strategy. This would include everything from savings and tax planning to your wealth planning and preservation requirements.

They can even help with more specific solutions, such as forming a special needs trust. Before selecting an advisor, ask about his or her training, qualifications, licensure, and previous experience with customers in similar financial situations to your own.

Later in the article, we’ll give you some specific ideas on what types of investments would be appropriate for different sizes of inheritances.

2. Splurge … A Little

There may be the opportunity for a bit of fun once you’ve invested your inheritance responsibly—but indulge wisely.

Avoid spending a lot of money on luxury products.

An expensive car may be appealing, but Insurance, upkeep, and property tax are all extra fees that come with a luxury car.

Invest in Memories: A family vacation, on the other hand, might be well worth it. And could create some enduring memories Remember, spending on experiences makes people happier than spending on things.

3. Create a 529 plan or an ESA

Education has a hefty price tag. If you have children who have just received an inheritance gift, consider placing those funds into a college savings plan, such as a 529 plan or an education savings account (ESA).

Both types of accounts may provide tax-advantaged assistance in meeting educational expenses.

A 529 plan allows for tax-free withdrawals for college expenses such as tuition, housing and board, fees, and textbooks.

Meanwhile, an ESA plan may assist with qualified expenses such as elementary, secondary, and post-secondary tuition, as well as vocational courses.

4. Planning to Spend an Inheritance Wisely

If you find out that money is coming your way right now, don’t feel obligated to spend it all right now. It is always a good idea to allow yourself some time to think through various options, research and discuss with trusted friends.

It’s perfectly acceptable to deposit the inheritance check into a federally insured credit union or bank account while you examine your current financial status.

- Try to evaluate your financial situation for a moment.

- Do you owe someone money?

- How much debt do you have?

- Have you accumulated an Emergency Fund with 6 months of living expenses?

- Do you have enough money set aside for retirement?

- Do you have children in school who would benefit from a college savings account?

Consult a financial advisor to assist you in assessing your financial strengths and shortcomings. Take some time to think about the inheritance gift and find out where it can benefit you most.

5. Pay Off Debt with Inheritance Money

While it’s challenging to resist spending sudden cash, it may be wiser to use an inheritance to pay off debts rather than incur new ones.

If you’re paying 16 to 21 percent interest on credit card debt, the savings could be huge.

While paying off debt quickly isn’t technically an investment, it can help you save money in the long run. This is provided that you have your spending under control.

The Dangers of Paying off Debt Quickly

One thing Steve & Annette from MoneySmartFamily encourage families about is to consistently use a budgeting system to manage their money.

If you were to suddenly pay off all credit card debt and find yourself with an extra $200 to $1000 each month to spend, you could easily end up back in debt.

This is because without a system to manage your spending, and without having worked through the process of systematically paying off debt, your spending habits will quickly return to their prior condition.

Spending more than you bring in each month leads to debt.

So before you pay off your entire debt, it is recommended that you live using a budget that helps you manage your expenses for at least 6 months.

Using your budget to start paying down your debt is a great discipline to experience. And once you have your spending under control, paying off the debt and experiencing the monthly increase in income won’t derail you.

Steps to Eliminating All Debt

You’ll have more money to put toward your investments and fewer financial commitments to deal with over time.

If you have many student loans or credit cards with high-interest rates, debt reduction is handy.

A windfall, such as a cash inheritance, allows you to make a one-time payment, which can help you.

Pay off a high-interest account by paying the debt to zero. Close accounts to reduce your estimated payment date for all of your student loans.

Debt Snowball

Debt snowballing is a debt-reduction strategy that can help you pay off your debt faster. With this strategy, you prioritize the accounts with the smallest balances while making minimum payments on your larger bills.

Then you work your way up the debt list until you’ve paid off all of them.

Read more about the Debt Snowball from Dave Ramsey.

This method isn’t suited for everyone, but it can be beneficial if it immediately motivates you to see debt-related bills disappear from your monthly budget. You might also try debt avalanche, which is paying off the highest-interest accounts first.

Debt Avalanche

Debt avalanche may be your best bet if you are motivated by knowing that the most expensive debts are addressed first.

6. Use the Inheritance to Secure your Retirement

For retirement, you should save and invest as much as you can. Although some loved ones leave their heir’s retirement accounts (IRAs), inheriting a lump sum of money might still help you plan for retirement.

Because an inheritance cannot be used to start or fund a conventional IRA or a Roth IRA, but it can help you in other ways.

An inheritance may provide a financial cushion for expenses, allowing you to contribute to an existing conventional or Roth IRA to the full extent possible.

There are, of course, alternatives to IRAs that can assist you in achieving your retirement financial goals.

Depending on your goals, priorities, and risk appetite, you may consider options such as certificates of deposit, index funds, and making your own stock market decisions through a brokerage account.

You have the option of concentrating on one sort of investment or a combination of them.

A financial advisor can help you build a strategy that emphasizes retirement accounts appropriate to your position, which is one area where a financial counselor may help.

Smart Things to Do Summary

As you can see, making wise decisions with inheritance money takes some time and usually involves other advisors. But in the end, by investing your time in planning and research you’ll be able to enjoy your inheritance for many years to come.

6 Worst Things to Do with Inherited Money

Now that we’ve given you several good ideas for what you can do with your newly found money, let’s talk about what you might want to avoid.

1. Attempting to Make Money too Quickly

Even when you have a large amount of money, you may feel a desire to make it grow into a lot more money.

If you aren’t an experienced investor or venture capitalist, work your way into the investment arena slowly.

There are many people who may approach you with “great investment opportunities” or heart-wrenching stories in need of loans.

It’s not uncommon to hear of people with newly found wealth losing it all when they put it into a “sure thing.” It’s especially crucial to be cautious of anyone who claims to have a “guaranteed” investment.

You should also be careful about telling friends or family members about your financial windfall.

2. Quitting Your Job Because You Inherited Money

It’s generally not a good idea to quit your job just because you received an inheritance. The only exception to this might be if you come from an affluent family with a large trust fund that provides you with monthly income.

At the absolute least, give yourself some time to research how to best use the money to improve your financial situation.

It’s crucial to remember that taxes will definitely reduce the amount of money you receive. Even if you decide that quitting your job is the best option for you, it’s a good idea to give yourself some time to consider the ins and outs of this.

3. Rushing into Any Decision

When it comes to sudden money, it’s usually a good idea to avoid making snap decisions, and this is especially true for younger recipients.

It’s better to wait until you’ve had time to contemplate, counsel, and plan before making large purchases or investments.

Unfortunately, it’s all too common to overestimate the value of an inheritance.

Even a small inheritance can persuade many young beneficiaries to believe that their newfound fortune can do more and endure longer than it does.

Some young beneficiaries may change their career and educational choices due to the perceived influence of an inheritance.

Rather than deviating from college or professional plans, it may be preferable to continue life as it is and set the inheritance money aside for the future.

Before making any big decisions, developing a game plan that examines the financial implications of inheritance will help to provide clarity. And as a result of this clarity, you’ll make wiser decisions.

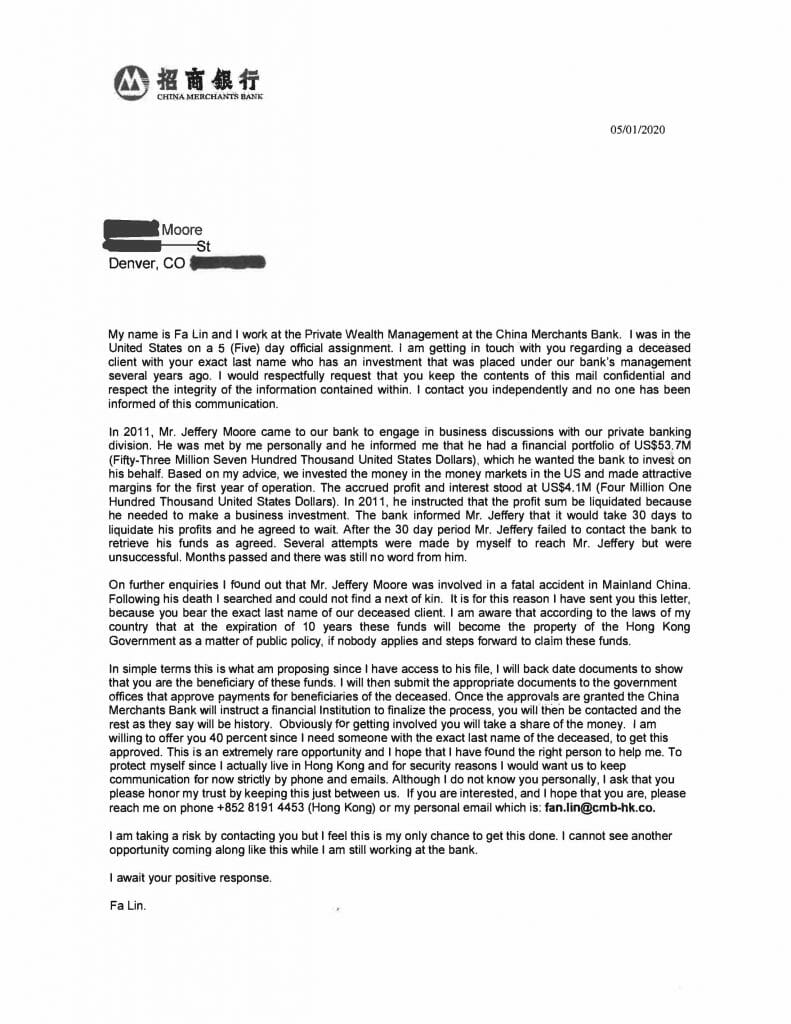

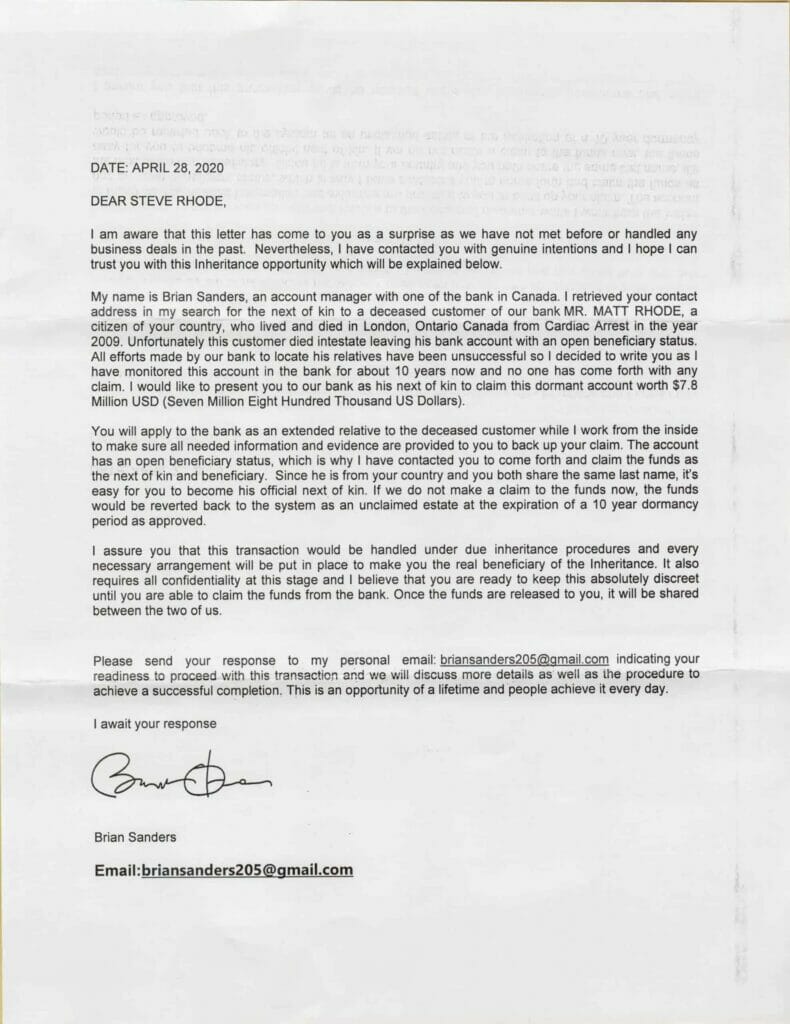

4. Trusting a Random Caller

If your inheritance is at all publicized you may receive phone calls requesting that you send funds to them to pay for inheritance taxes and fees.

You may also receive a letter from an estate locator advising you of an unclaimed inheritance.

Scammers will say that accessing your alleged inheritance is difficult due to government laws, taxes, or bank constraints and that you will have to pay a small amount of money and submit personal information to claim it.

Once they have your personal information and money, they’ll want to get your bank account information so they can transfer the inheritance to you.

A second or third fraudster may be presented to you, appearing as a banker, lawyer, tax agent, or financial assistance. Ensure you know where your money, checks, or credit card numbers are going before sending them.

If your inheritance was shared through public disclosure in the courts or online you could easily become a target for a number of scammers. You might consider changing your phone number and other contact information to protect your privacy.

Learn more about inheritance scams from Probate Advanced.

5. Becoming a Venture Capitalist

It can be tempting to invest in the businesses of friends and family members. Unfortunately, most of these types of ventures fail. It is very appealing to build an investment portfolio and manage it to grow into a lot more money.

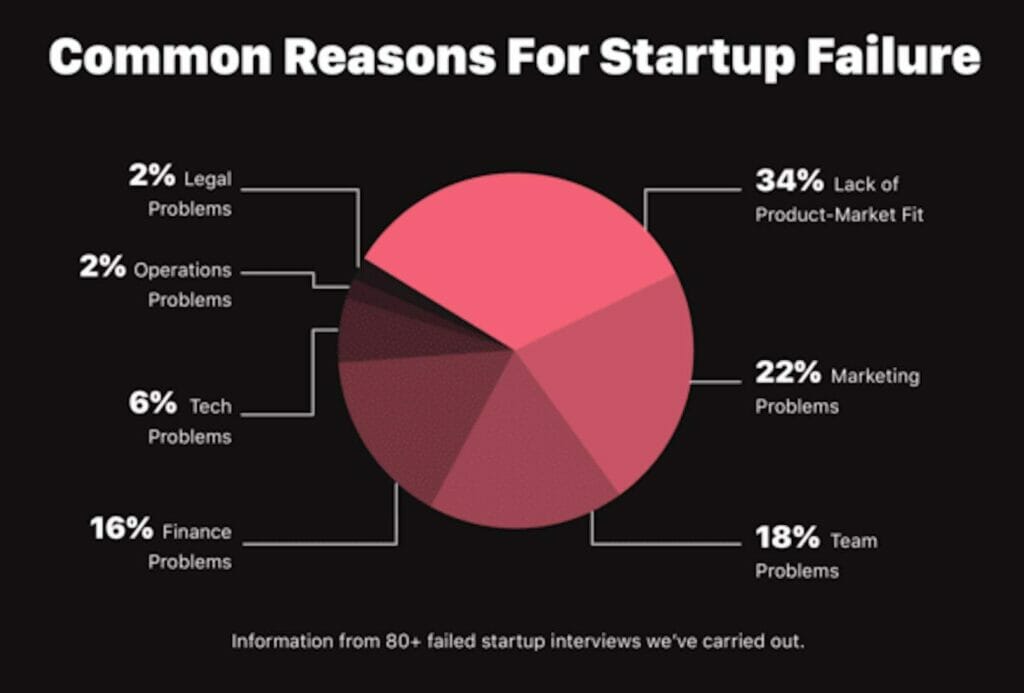

According to Investopedia the Start-up Failure Rate is:

“In 2019, the failure rate of startups was around 90%. Investopedias’ research discovered that 21.5% of startups fail in the first year, 30% in the second year, 50% in the fifth year, and 70% in their 10th year.”

The website Failory produced this chart highlighting the main reasons for the failure of start-ups.

But if you don’t have a lot of experience with startups or running a business and rush into this decision it could be very costly. You may end up with a broken relationship with your friend or relative in addition to losing whatever money you “invested.”

If you aren’t experienced in venture capital type of investments you could be a target for less than ethical for investment opportunities. Why would legitimate business people come to you as an individual rather than going to one of the more well-known venture capital firms? Most likely they have been turned down by the experts and are looking for someone who is less knowledgeable.

6. Investing It All In One Place

Failing to diversify your investment is a big mistake.

Professional investors may produce a higher return than the benchmark by investing in a few concentrated positions, but average investors should avoid doing so.

It is preferable to adhere to the diversification concept. It’s critical to include exposure to all key sectors in an exchange-traded fund (ETF) or mutual fund portfolio.

Include all primary industries in your stock portfolio.

As a general rule, don’t put more than 5% to 10% of your portfolio into any single investment.

Now that we’ve addressed some smart decisions and some less intelligent inheritance decisions, let’s answer some commonly asked questions about inherited money

Smart Inheritance Questions

There are a number of other questions you might be asking about smart things to do with inherited money.

1. Should You Pay Off Your Home Inherited Money?

Paying off your mortgage is a risk-free investment because you know exactly what rate of return you’ll get, and market conditions won’t alter it. Being “Mortgage-Free” is an awesome financial accomplishment. Read how Steve & Annette from MoneySmartFamily paid off their first home in 9 years on an average income of $33,000.

Once your home is paid off you can take the equivalent of your mortgage payment and put it into your IRAs, or other investments.

If you do that, you’ll have built up a sizable retirement portfolio in 10-15 years.

Being debt-free can bring peace of mind, and while it’s difficult to quantify in dollars and cents, it’s a beautiful feeling that will lift some of the weight off your shoulders.

Create an emergency fund for unforeseen emergencies.

Steve and Annette recommend establishing a 5 part emergency fund.

- Emergency Medical Expense: The maximum out-of-pocket for your family (this could be put into an HSA or other tax-deferred account).

- Emergency Unemployment: 3 to 6 months of living expenses

- Emergency Travel: Enough money to fly or drive your family to your parents’ or other beloved relatives’ bedside.

- Emergency Home Repair: One percent of the value of your home

- Car Replacement: putting aside money to buy a car when your old one needs to be replaced.

All of these emergency situations will be less stressful if you know that you’ve got the money saved.

The ultimate goal of investing and, more broadly, retirement planning is financial security.

Paying off your home and having an emergency fund creates a solid financial foundation. This ensures that the cash set aside for investments isn’t suddenly required to cover a bill or an unforeseen need.

If you already have an emergency fund, now is an excellent opportunity to review your spending and, if required, add to it.

The Family Emergency Binder

Organize your family’s most important information – from finances to traditions to bedtime stories – so you’re prepared, no matter what happens.

The link below will take you to the EmergencyBinders.com website – an affiliate of MoneySmartFamily.com

2. Where Should I Put My Inherited Money?

It’s a good idea to engage a financial planner if you tend to overspend or can’t keep up with your costs.

They will assist you with investing money in the short term and long term.

Make sure you select a planner who does not work on a commission basis.

Steve & Annette have engaged two different financial planners. One for their IRAs and a second for their investments. The investment advisor is a fiduciary – which means he’s held to a high standard of making decisions that benefit the client, not just the advisor with commissions.

You may want to initially “park” the money in an investment money market account or an FDIC Insured bank account.

A financial advisor can help you invest your money wisely, predict when the market will rise, and help you save for retirement.

3. How Do I Protect Myself from Inheritance Scams

What is an inheritance scam, and how does it work?

An inheritance scam is a con that employs the story of a person who has passed away and bequeathed their estate to the scam’s intended victim.

The scam usually starts with an email or letter claiming that the recipient is a distant relative of someone they’ve never heard of.

The person who sent the email or letter just died, and the law firm that sent it has been looking for relatives to accept the request.

Even if you’ve never heard of the person who died, there are a few aspects that make this con plausible.

The letter appears to be from a law firm at first glance. And if you conduct an online search, you will discover that the organization does exist.

To make their correspondence appear more genuine, the scammers use letterhead and the name of a law company.

How to Spot an Inheritance Scam

On the surface, inheritance scams appear legal, yet they often contain many subtle clues that they are fraudulent.

It’s most likely a scam if you’re unsure about the integrity of an email or message containing any of the following characteristics:

- Mistakes in spelling or odd grammar

- Fake address

- Huge inheritance claim

- Vague details about the deceased rather than a specific name, address or age.

- Email address that is not from the domain of the bank or law firm. Often it will be a Gmail address.

Here are a couple of fraudulent inheritance letters.

If you are contacted by a potential scammer:

- Do NOT respond to the email.

- Avoid giving out any personal details.

- Ignore suspicious links and messages.

- Look on the internet to see whether anyone else has flagged the email as a fraud.

- Report the scam immediately.

- Notify your bank, financial institution, or other appropriate organization about the scam.

- If you’ve sent money to the scammer, report it to your local authorities.

- Protect your credit cards, documents, and accounts by locking them up.

- Change your username and password for your account.

4. Will I Have to Pay Taxes on Inherited Money?

With inherited investments, one thing to keep in mind is the potential tax ramifications.

You are not personally liable for taxes on inherited stocks because the estate bears the tax burden.

They also have a stepped-up tax basis, which means you only pay taxes on the amount paid for the shares by the original owner.

If you sell shares, however, you will be subject to taxes.

RMDs (required minimum distributions) are another critical consideration if you inherit an IRA from someone other than your spouse.

In this situation, you must withdraw the entire amount from the IRA.

RMDs are taxed as income if the IRA is a regular IRA rather than a Roth IRA. As a result, you may face a significant tax bill.

Tax-Free Inheritance

As a beneficiary, your inheritance is usually tax-free when you inherit money.

Because any income received by a deceased person previous to death is taxed on their final individual return, it is not taxed again when it is handed on to you. It may also be taxed on the estate of a deceased person.

Taxing it twice, once to the recipient and once to the estate, would result in double taxation, which the US tax laws are designed to avoid.

This is true whether the money comes from a family member or a friend.

You do not have to be connected to the person who gives you an inheritance.

Not all money left to you by a loved one is tax-free.

For example, if the decedent possessed tax-deferred retirement accounts such as IRAs or 401(k)s and transferred them to their heirs, the money would be taxable to the beneficiaries in the year they received it since the money has never been taxed before.

5. Do I have to Pay Taxes on an Inherited House or Property?

Inherited property is considered income for the year you sell it and must be included in your tax calculations.

If you inherited the property, you must pay a 50% capital gains tax on the difference between the fair market value and the price you paid for it when you obtained it.

You don’t pay taxes on the total worth of an inherited home since it has a stepped-up tax basis.

Instead, you only pay taxes if the house sells for more than it was worth when you inherited it.

If homeownership is something you’ve always wanted but didn’t have the financial means to achieve, staying in your inherited home can be an intelligent option.

Before obtaining a mortgage, many banks need a substantial down payment. Staying in your inherited house can help you overcome this obstacle.

Also, don’t forget about property taxes and the never-ending maintenance that comes with owning a home.

3 Different Strategies for Small or Large Inheritances

There are a variety of things you can do with inherited money. And if you have a small, medium, or a large amount of inheritance, the strategies would vary. In this next section, we’ll present several options for different-sized inheritances.

- Inheritances Less Than $100,000

- Inheritances Between $100,000 and $400,000

- Inheritances Greater than $500,000

1. What Should You Do with a Small Inheritance — Less than $50,000?

Investing in yourself is usually the best investment you can make. $50,000 might be put to good use in learning new skills, getting new certifications, or starting a micro business.

Other Options

You could fund your IRAs and other tax-exempt or deferred vehicles.

The problem with investing in the stock market, real estate, or startups is that they all have the potential to lose some or all of your money.

It is impossible to overestimate the value of an investment in your own education and skills.

Can you imagine how successful you’d be if you spent $50,000 on a university education or top-rated online courses, technical certifications, or mastermind groups? Especially if you finish the course of study AND put what you learned into practice?

Giving to Charity or Church

It’s okay to give away some of your newfound money. There are hundreds of well-managed charities, ministries and churches that could multiply the money you contribute.

Investments

Of course, we always recommend getting good advice and finding competent advisors to help you plan. If you don’t need the money now, put it into investments with an experienced and successful investment advisor.

Valuable Items

If part of your inheritance is collectible or antique items, hire an expert appraiser to determine the value and the best venue for selling the items.

You must know what you possess if you inherit stocks, bonds, real estate, precious collectibles, and other assets.

Investing, on the other hand, is a different matter.

You should evaluate financial assets ranging from stocks, bonds, mutual funds, and ETFs to less often traded private equity and other investments.

You’ll probably wish to sell some of your assets and reinvest the proceeds.

What Should You Do with a Large Inheritance — $100,000 – $250,000?

First, it’s necessary to sketch out your life and financial goals before determining how to invest the funds. Everyone’s ideal investment strategy is different.

However, some broad financial principles will help you expand your inheritance over time. Use well-researched investment principles to establish a wise and long-lasting investment strategy, whether you hire a financial advisor or do it yourself.

Be sure to put some money aside for a fully-funded Emergency Fund account.

The next step is to determine your risk tolerance and time horizon, as this will decide how much money you should place in mutual funds and stocks versus bonds or fixed funds. With the help of a risk tolerance questionnaire, you can perform this activity with your financial advisor or on your own.

Depending on the results, you’ll invest anywhere from 20% to 90% of your money in stock funds, with the rest in bond funds.

You could include the following items in the stock and bond category:

- S&P 500 large-cap funds in the United States

- Mid-cap stock funds in the United States

- Developed stock funds from around the world

- Emerging Markets Investment Trusts

- Bond funds managed by the government

- Bond funds with a high yield

- Bond funds from throughout the world

- Commodity funds Real Estate Investment Trusts (REITs)

Diversify your investments by selecting some for stability and others for growth.

If you can do it and you’re clever, you’ll have more than enough money to live comfortably while still having money to reinvest.

Put a significant percentage of that money into rental properties, which generate significant income through rents and allow us to grow your wealth through the appreciation of your real estate properties.

What Should you Do with a Huge Inheritance – Greater than $500,000?

Use the funds to further your education, relocate, or do whatever it takes to get your life on track to reach your goals and dreams.

Your earning potential is your most acceptable investment. Create a strategy that will allow you to increase your income for many years to come. This could be through career training, going back to school, or starting a passive income side hustle.

Invest the rest of your money in tax-advantaged retirement plans during your working years.

If you have children, use a portion of the inheritance to set aside money to pay for their college educations.

You could also sell your current home and purchase a larger one. Just remember that larger homes come with larger associated costs including higher property taxes, utilities, and maintenance costs.

Don’t buy a new vehicle. Most vehicles depreciate quickly and if you’re wanting your inheritance to last, this isn’t the way to do it.

Be grateful that you have enough money. Investing in a huge inheritance requires foresight, clarity of thought, and sound judgment.

Don’t feel obligated to “go it alone.” It’s certainly worth the money to hire a financial advisor to ensure that you’re not being scammed, or missing good investment opportunities or that you’re maximizing your tax advantages with your investments.

Smart Inheritance Conclusion

Inheritance may be both a blessing and a curse. It will eventually be determined by the outcomes of asset dispersal and what you do with those assets.

While some investments may lose money in the short term, with a good plan and good advisors you’ll see your inheritance grow and flourish.

Don’t be afraid to get help if you’re feeling overwhelmed.

You might start your search with the individual or people involved with the estate before it was handed on, such as the executor or a trustee.

You might elect to hire a fiduciary, such as a Certified Financial Planner (CFP). You can employ a CFP on your own or find one on the internet.

Author Bio: Lyle Solomon has considerable litigation experience as well as substantial hands-on knowledge and expertise in legal analysis and writing. Since 2003, he has been a member of the State Bar of California. In 1998, he graduated from the University of the Pacific’s McGeorge School of Law in Sacramento, California, and now serves as a principal attorney for the Oak View Law Group in Rocklin, California