This summer, we were asked by a local Fox TV station to participate in several segments that addressed saving on back-to-school expenses —including college costs. During our research for the segments, we uncovered some new information not included in our earlier articles on College savings.

The average college student is now graduating with $20,000 worth of debt. Most graduates take 10 years or more to pay it off. If you spend a little time applying for scholarships and shopping carefully for books, you can trim or eliminate any borrowing. This past year our daughter Becky graduated with her Associates Degree in Equine Science. But unlike most students, she received her diploma with no debt and about $2800 worth of excess scholarship money to boot!

There are always ways to save on college costs. You don’t have to be Sherlock Holmes to find great deals, but some “elementary” deductive reasoning could help you uncover a cache of loot. Here are three ways a super-sleuth can get the best education possible for the least cost:

1) Financial Aid — Thousands of dollars are available NOW!

- a) Financial Aid Help Visit your university’s website or financial aid office. They should provide you with a packet of information on specific scholarships they have available. Be careful — if you indicate that you are willing to take out loans, most financial aid staffers will stop looking for scholarships and just submit your application for a loan. Encourage them to work a little harder to find the money you qualify for. For more information read our blog “Is there Gold at the End of the Scholarship Rainbow?

- b) FAFSA The Free Application for Federal Student Aid (FAFSA.ed.gov) is your next line of attack for finding scholarship money. Applying is a two-step process, first you’ll want to register for a PIN number so you can electronically sign your application. It will take a few days to receive, so do this right away at this website: https://studentaid.ed.gov/sa/fafsa/filling-out/fsaid. Second, completely fill out the application (this can be done on a paper application picked up at your financial aid office, but the online application is processed faster). You’ll need income tax and savings information for the student and parents. Allow about 90 minutes to complete the online application (the site is not all that easy to use, so be prepared to scratch your head a few times and wonder what you should do next). Your FAFSA information is sent directly to the colleges/universities that you specify. This information is used to determine eligibility for most federal and some local scholarships and grants. The deadline is September 15, but the best time to fill it out is in January or February.

- c) Ben Kaplan, the Scholarship Coach read his books: How To Go To College Almost for Free and The Scholarship Scouting Report. All are excellent resources for learning the ins and outs of applying for and getting scholarships. He recommends various scholarship websites including our favorite: FastWeb.com.

2) Save Thousands on Textbooks

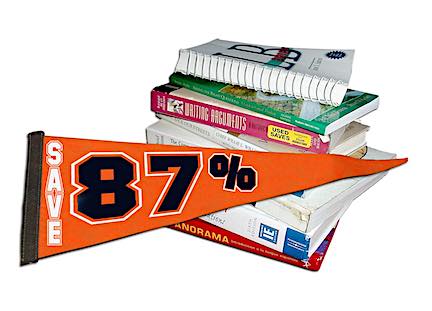

The average cost for a semester’s worth of books is $500 to $900. By doing a little sleuthing, we’ve found savings as great as 87% on books needed for this past semester. If you can drop your cost for books by at least 50 percent, you’ll save thousands over the course of your studies.

Here’s what we do. Once they’ve signed up for their next semester of classes, (a couple of months before the semester actually starts) Becky and Roy go to the school bookstore and get the exact title, ISBN (International Standard Book Number), author’s name, and edition of the book(s) required for each class. Then we start checking various websites to find the best prices on that specific book (always read descriptions very carefully watching for inaccuracies in edition or ISBN numbers). We’ve had the best luck finding good deals on eBay.com and Half.com, but here are a few other sources we check out:

- Buy used at your college bookstore and save about 25 percent

- CollegeBooksDirect.comcan save you 25 to 40 percent

- CheapestTextBooks.com– This site searches several other websites for the best prices on the books you want.

- eBay.com— we found savings as high as 87 percent

- Amazon.com— great savings on new and used textbooks

- Amazon.co.uk—Believe it or not, purchasing hard to find textbooks from Amazon’s site in the United Kingdom can save you some dough (even with the cost of international shipping included).

3) Getting Quality Instructors

With the average class costing anywhere between $185 at community colleges to $900 at some universities, be sure you get your money’s worth. You are purchasing a service, so get the best quality you can.

The best way to find great instructors is to get referrals from other students. Another option is to speak with the Dean of Students or Dean of Instruction about the teachers with the highest student retention ratios. But there is a third source you can tap for great teacher referrals:

RateMyProfessors.com This is a free website where students rate their professors teaching ability, knowledge of the subject they teach . . . and their looks. There are more than 700,000 professors from 6,000 schools represented on this site. For those with younger kids in school, check out RateMyTeachers.com—a website that is focused on providing similar ratings for K-12 teachers.

Saving money on college expenses is no different than any other investigation or research project. The more time you spend looking for clues, researching options and asking questions, the more money you’ll save. As a detective who tirelessly applies for scores of scholarships, uncovers great deals on textbooks and tracks down great instructors you will avoid the normal college snares of loans and long-term payments. Instead, you’ll enjoy an excess of cash and move on to your next challenge — a lifetime of fulfilling work, earning, saving and sharing with others. CASE CLOSED!