If you haven’t heard about how a cash balance plan can help you sock away 10x more pre-tax dollars than a 401(k) or IRA – get ready to be empowered and informed.

A tax-saving strategy for high-income earners

Saving money on taxes is a game we all should be playing. One of the strategies of the millionaires among us is to pay their fair share of taxes but to leverage every possible legal loophole to pay less.

While we aren’t earning millions of dollars, our earnings from this blog and other ventures are growing. We also have several blogging friends who are earning mid to high six-figures from their online businesses. We’re all looking for ways to maximize the amount of money we can shelter from taxes to save for retirement.

To make this article as accurate as possible we reached out to Matt Ruttenberg from LifeIncrs.com. We spoke with him about retirement plans that allow you to put away more money than traditional IRAs.

Matt is the Chief Marketing Officer of Life, Inc. Retirement Services, an exclusive retirement plan firm. He is a third-generation financial expert. We worked with Matt to craft this information for your benefit.

TABLE OF CONTENTS

- 1 A tax-saving strategy for high-income earners

- 2 What is a Cash Balance Plan?

- 3 The Popularity of Cash Balance Plans

- 4 Cash Balance Plan vs IRA and 401(k)

- 5 The Pros Of The Cash Balance Plan

- 6 The Family Emergency Binder

- 7 The Cons Of The Cash Balance Plan

- 8 Who Should Consider A Cash Balance Plan?

- 9 Cash Balance Plan Wrap-Up

Tax management can be a popular subject among writers, bloggers and business owners.

Many employers think that a 401(k) plan is all that’s available in the form of a retirement plan to assist in offsetting their tax burden. They think it is the best option for putting more away than in a traditional IRA or Roth IRA. In reality, a 401(k) plan is just the tip of the iceberg.

There is a lesser-known option called The Cash Balance Plan.

In this article, we’ll dive into the pros and cons of a Cash Balance Plan. We’ll also uncover who is best suited for this 6-digit pre-tax savings strategy.

Important Take-Aways about Cash Balance Plans

1. Cash Balance Plans increase the tax savings for an employer.

2. Cash Balance Plans let employees contribute more toward retirement than if they only have a 401(k).

3. Cash Balance Plans are a good fit for organizations that are consistently profitable and have a consistent cash flow.

What is a Cash Balance Plan?

Technically, a Cash Balance Plan is considered a defined benefit plan, which is similar to the pension our parents or grandparents may have known and loved.

With a pension, the employee is guaranteed a monthly payment after a certain age. This is like an annuity, however there is no way to receive a lump sum payout of the money.

Defined Benefits Plan – According to Investopedia:

“defined-benefit plan is an employer-sponsored retirement plan where employee benefits are computed using a formula that considers several factors, such as length of employment and salary history. The company administers portfolio management and investment risk of the plan.”

A Cash Balance Plan is also similar to a 401(k) plan, or defined contribution plan because it carries a cash balance.

Also similar to a 401(k) plan, when you retire, you can roll the funds over to an IRA in a lump sum. However, like a pension, you can also choose to receive annuity payments over your lifetime.

Most companies that have a Cash Balance Plan also have a 401(k). Employees are allowed to contribute to both.

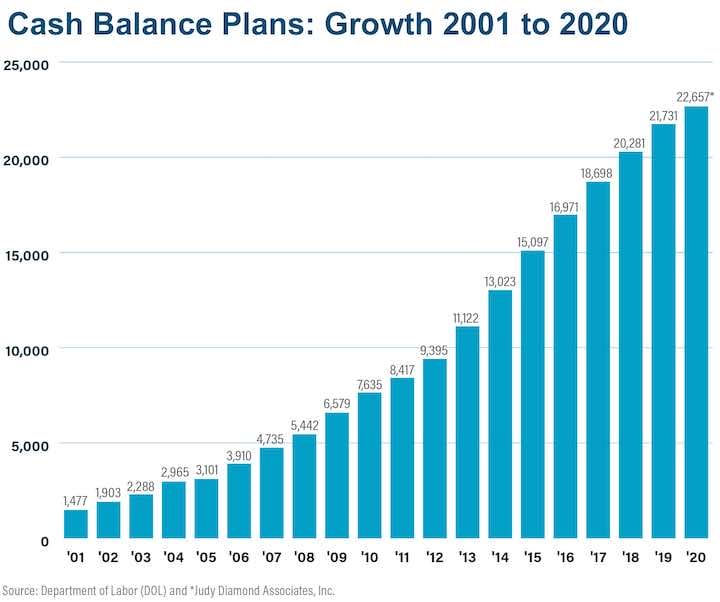

The Popularity of Cash Balance Plans

Since its creation in 2001, this type of tax-deferred vehicle has seen double-digit growth. There are now more than 22,000 companies that are offering these plans to employees.

This chart is part of an article from Index Fund Advisors.

__________

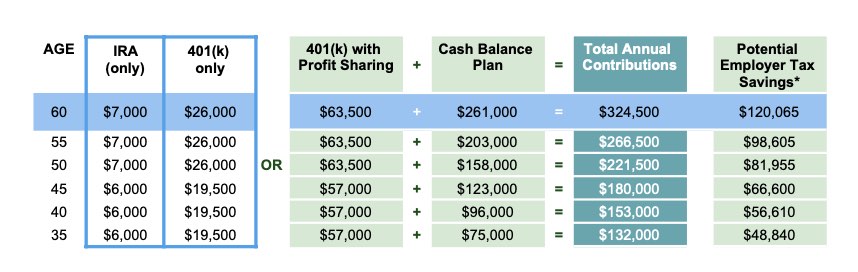

Cash Balance Plan vs IRA and 401(k)

The chart below shows the different amounts that you can allocate to various types of defined benefit plans.

Cash balance calculations are based on a goal of 2.9 million dollars at retirement (age 62)

Numbers are rounded and are used as examples – your actual numbers will be different.

_________________

How Does Money Get into A Cash Balance Plan?

An employer will make regular contributions towards the fund along with the interest credit that is required. This credit is outlined by the actuary.

According to OctoberThree.com interest credit is:

“More than 35% of cash balance plans provide interest credits based on yields on a long-term index, such as 30-year Treasury bonds. Another 30% of the plans use an index (typically either a short-term or long-term Treasury security) with a minimum crediting rate of at least 3%.”

The underlying investment of the plan may or may not cover the required interest. These are commonly invested in a very conservative vehicle to limit the chances of volatility so the employer won’t need to come up with any unexpected contributions to recoup losses.

The contributions into the plan are based on a calculation of age and tenure in the company.

Often there is a vesting schedule added to incentivize employees to remain with the company, although this isn’t required.

RELATED ARTICLE: How Frugal Living Helps Your Retire Early

The Pros Of The Cash Balance Plan

There are many reasons that people start their own businesses. But some of the most common reasons are:

- Creating your own hours

- Controlling your future

- Building something you and your family can be proud of

So, why not take advantage of some of the amazing tools that are available to business owners!?

The Cash Balance Plan is one of these tools.

We’ve already discussed how its unique design allows you to enjoy the ability to roll the funds to an IRA in retirement or have access to annuity payments over your lifetime.

There are three additional benefits to consider with a Cash Balance Plan:

1. High Contribution Limits

This is one of the big reasons business owners select a Cash Balance Plan. The higher contribution limits are what usually get the attention of business owners when they first learn of this vehicle.

The contributions are based on age, as we mentioned earlier. The older you are, the higher the potential. For example, a 65-year-old could contribute as much as $285,000 in 2020 according to a report from Investopedia.

This is in addition to contributing towards a 401(k) and/or profit-sharing plan.

That isn’t something to sneeze at by any means. When compared to contributing to other vehicles such as an IRA, the most you can contribute is $7,000 in 2020 if you’re over 50 years old.

2. Consistent Returns

Cash balance plans grow from a combination of contributions from the employer and a pre-determined guaranteed interest rate based on an index.

According to an article from cashbalanceplans.com, it commonly uses the 30-Year Treasure Bond yield. This changes every year but has hovered around 5% recently.

This is a refreshing change from most other retirement plans where you’re dependent on the stock market to grow your savings. When pairing the two together, you’ll have a nice diversified portfolio while you near your retirement goals.

3. Paying Fewer Taxes

Paying fewer taxes goes hand in hand with our first advantage. Often, as employers start seeing higher profits, they tend to hold a stockpile of cash in the company so they don’t take the tax hit.

Contributions into a cash balance plan reduce your adjusted gross income. This is integral to reducing your overall taxes. Not to mention the funds grow tax-deferred inside the plan.

This can be a good strategy to start getting those profits out of the company as the employer starts getting closer to retirement.

Planning for Emergencies

Part of a good retirement plan is having the ability to keep track of all of your important information. That’s why we recommend assembling a Family Emergency Binder.

The Family Emergency Binder

Organize your family’s most important information – from finances to traditions to bedtime stories – so you’re prepared, no matter what happens.

The link below will take you to the EmergencyBinders.com website – an affiliate of MoneySmartFamily.com

The Cons Of The Cash Balance Plan

Now that we’ve discussed the advantages, let’s cover the disadvantages. You’ll see that this much tax savings power comes with a cost.

There are three distinct disadvantages to a Cash Balance Plan:

1. Expenses

The costs associated with a cash balance plan can be pricey. The reason is due to the need for an actuary.

Since t these plans are so complex, the actuary has many tasks. They analyze and certify that the plan has been properly funded for the year and they perform regular valuations to ensure that the plan can withstand any future rollovers, rate changes, or proposals to the plan design.

And with this, are the regular costs of the 401(k) plan, advisory fees, and administration costs.

When considering a plan of this type, evaluating the costs versus the tax savings is key. Yes, there are higher expenses, but the tax savings might outweigh what you’re paying in fees.

2. Higher Employee Contributions

The second disadvantage is the cost of contributing more to the employees. This would be on top of what they are contributing and matching in their employee’s 401(k) and profit-sharing plans.

As I mentioned before, the contributions are based on age. So, a company with an older staff will tend to contribute more to their employee’s accounts.

Due to these requirements, cash balance plans are used more often by small businesses with less than 10 employees or “solo-prenuers”.

3. Sponsor Carries the Investment Risk

Unlike a 401(k), the results of the cash balance plan are the employer’s liability.

In a 401(k), if the markets suffer a loss, it’s on the employee to make changes. The employer’s responsibilities stop at giving the employees access to the plan and making any required matching.

Yes, the funds are invested in an underlying conservative portfolio. However, if they don’t keep up with how the cash balance plan was designed by the actuary, it’s up to the employer to make additional contributions.

Who Should Consider A Cash Balance Plan?

Commonly, doctors and lawyers are used as good examples because they tend to be higher-income earners. Older prospects are also targeted because of the ability to remove excess cash out of the company in a short, but tax-efficient basis.

Data gathered from the 2017 Cash Balance Research Report – CashBalanceDesign.com

But in reality, cash balance plans are a great choice for any industry or age. Here are a few good scenarios of those who might be a good fit:

- Employers With Independent Contractors – Independent contractors aren’t a part of your company. Which means you aren’t required to contribute towards their retirement. These types of employers are great candidates for a cash balance plan.

- Sales People – Often, those in a sales role might act as independent contractors. And even if you’re exclusive to a single company, you’re eligible to create your own retirement plan.

- Business Owners On The Verge of Retirement – A cash balance plan allows those close to retirement to remove access funds from their company without paying too many taxes. Contributions to the plan are considered tax-deferred.

- Business Owners with Younger Employees – The way the contributions are calculated, employees closer to retirement age are the ones who get the bulk of the contributions.

- “Solo-Prenuers” – These are business owners with no employees. By pairing an individual 401(k) with a cash balance plan, it can be very beneficial without the need for employee contributions.

PRO-TIP: If you’re married, don’t forget your spouse. By adding your spouse to your company, you’re able to bring even more tax-deferred dollars into your home.

RELATED ARTICLE: Best Retirement Gift Ideas

Cash Balance Plan Wrap-Up

Overall, these types of plans are becoming increasingly popular.

This is obviously due to the high amount of tax-deferred savings potential. Most often than not, the pros outweigh the cons for those with high income. The expense can be high, but the net savings you achieve from the tax savings are generally very positive.

But, for most employers, starting with a 401(k) or other retirement plans is a good place to start. Read more about basic plans in this article Matt wrote his website LifeInsrs. Having the ability to add on additional pieces like profit sharing and a cash balance plan helps with your long-term retirement planning needs.

About The Author

Matt is the Chief Marketing Officer of Life, Inc. Retirement Services, an exclusive retirement plan firm. He is a third-generation financial expert and die-hard Cleveland Browns fan from the Cleveland, Ohio area who now lives in sunny Southwest Florida.