Learn more about Steve & Annette Economides – America’s Cheapest Family, their 5 kids and their frugal, money-saving journey.

We want to build a community of people who want to Make Frugal Fun and to Save Money everywhere they can.

Our Mission:

MoneySmart Family exists to help you save money and make frugal living fun!

Our website has 3 core focuses where we share practical and achievable advice:

-

- Cutting Your Grocery Bill in Half

- Budgeting, managing and making money

- Teaching kids become financially independent

-

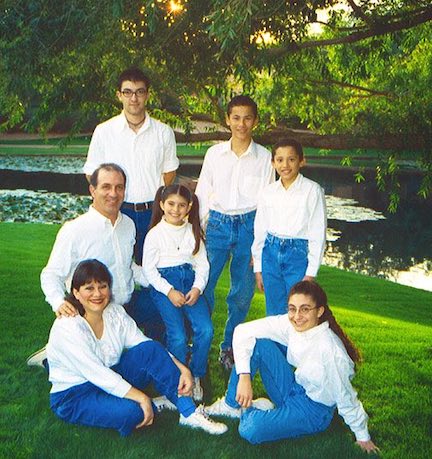

The Economides Family in 2003

The Economides Family – America’s Cheapest Family 2003. Back Row (l to r) John, Roy, Joe. Steve (kneeling) Abbey in his knee. Front Row: Annette and Becky.

The Economides Family Now

Economides Family Collage. Grown Kids and Grand Kids. Center: Steve & Annette. Top Left: John & Rachel with kids. Top Right: Becky & Nolan. Bottom Left: Joe and Sarah with kids. Bottom Right: Abbey & Collin with dogs.

Who are the Economides

MoneySmart Family is a Mom & Pop website with a global reach.

We are dedicated to helping you stretch your dollars and save money in every way possible.

At MoneySmartFamily, we provide written, downloadable, audio and video resources to help individuals, marriages, and families improve their financial lives.

We work hard to make our content as practical and easy to apply as possible.

How Money Smart Family Started

Steve & Annette Economides started their money-saving journey in 1982 when they got married. Money was so tight that they literally needed to stretch every penny just to survive.

In 2003 with five kids in tow, they launched their own website called the HomeEconomiser along with a printed newsletter.

The newsletter reached people in the southwestern area of the United States until Steve & Annette started getting interview requests.

Because of this media exposure, the website and newsletter really took off.

Our Financial Background

Steve & Annette first learned about budgeting their money in a marriage prep class at their church. From day-one of their marriage they utilized a money-management system. Their budget system helped them pay off their first home in 9 years, pay cash for all of their cars and help their kids get through college without student loans.

Financial Coaching Families

They were recruited by a financial planner at their church to help coach families who were struggling financially. They were trained by the financial planner. They also received training from Larry Burkett’s organization Christian Financial Concepts (now Crown Ministries).

Eventually, Steve & Annette were tapped to lead the finance ministry at their church. They not only coached families, but they recruited and trained other coaches.

Over the course of 10 years, their team of coaches was able to help hundreds of people right-side their finances.

Many of the stories in their books came out of this financial assistance ministry.

America’s Cheapest Family on National TV

In 2004 the Economides family appeared in their first national TV interview on Good Morning America where they were dubbed America’s Cheapest Family.

Because of this interview, the family and the brand were launched into the national spotlight. In subsequent years Steve & Annette have done more than:

- 30 national and international interviews

- Spoke at dozens of events encouraging thousands of people

- Authored three books:

- America’s Cheapest Family Gets You Right on the Money (New York Times Best Seller)

- Cut Your Grocery Bill in Half (#2 Amazon Best Seller)

- The MoneySmart Family System Teaching Financial Independence to Children of Every Age (Best Parenting Resource – Family Choice Award)

As a result of speaking, writing and interviews Steve & Annette are more passionate today than ever before to spread the good news about frugal living.

Where MoneySmart Family is Today

Steve & Annette’s kids are now grown and starting lives and families of their own.

Despite being empty-nesters, working together, Steve & Annette focus on blogging about personal finance and frugality topics, shooting YouTube videos and trying to keep up with ever-changing technology.

Still, their goal hasn’t changed. They want to help you find creative and amazing ways to live below your means and have an abundance of fun and laughter.

You can also connect with them on Social Media:

So, reach out to Steve & Annette by watching their videos or reading their posts. Leave a comment or send a message through this contact us form. They read every comment and usually reply quickly.

Financial Hope

As a result of decades of frugal living and practical budgeting, Steve & Annette believe that there is financial hope for everyone.

No matter who you are, what you are going through or what challenges your family may be facing, there is hope.

And we hope that we can encourage and empower you with what we’ve written on our website and in our books and videos.

We want to help realize that you can not only survive, but thrive financially.

Love you guys! Loved Amy Dacyzyn and Larry Burkett, too. What a great and godly crew to help us live well, but not waste.

Mae – you’re so sweet – thanks for visiting and sharing.