Doing a DIY Property Tax Appeal is not something many homeowners think about. But, if you own a home or are getting ready to buy one, you should consider what you will pay in property taxes.

And you should probably look into what similarly sized homes are paying.

When you purchase a house, be aware that many counties base their revised valuations, in large part, on the sale price. The basis for the valuation may be correct, but the details of your property may be misrepresented, which can result in higher taxes.

No matter what the economy is doing, taxes don’t seem to be taking a hiatus. We don’t know about your area, but where we live, property values keep increasing, and as a result, so does our tax bill.

How can you be sure you’re paying the proper amount for your property taxes? Pull up a chair, ‘cause, we’ve got a tale to tell.

TABLE OF CONTENTS

- 1 Is Your Property Overtaxed?

- 2 The County Assessor Turned Us Down

- 3 Do You Have Un-permitted Improvements?

- 4 The County Assessor Visit

- 5 The Floor Plans Originally Submitted Didn’t Exist

- 6 How Does the Property Tax Appeal Really Work?

- 7 The Role of the Board of Equalization

- 8 The Property Tax Appeal Resolution

- 9 Freezing Property Values for Seniors

- 10 Cautions for a Property Tax Appeal

- 11 TAXES ARE TAXING

Is Your Property Overtaxed?

For years, we had a sneaking suspicion that our property was being overtaxed—the assessed value seemed way too high. But every time we’d read through the appeal process, we’d either missed the deadline or our eyes would glaze over as we pondered the jumbled mass of bureaucratic red tape.

So year after year we did nothing.

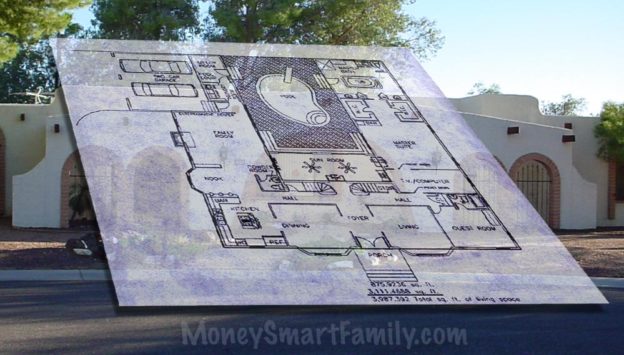

About the photo above: If you don’t have a blueprint of your house, you can measure and compare your figures to your county’s records. Our assessor figures square footage based on the perimeter of the house, minus any unlivable areas, such as garages, storage areas, and patios.

A few years ago, through the wondrous “miracle” of the Internet, we discovered that various state, county, and city agencies were putting recorded documents and other public information online.

As a result, we were able to do some free sleuthing about what our neighbors were paying in property taxes and that confirmed our suspicions.

Searching Property Taxes on the Internet

We logged on to our county assessor’s website and were able to check out the assessed value of properties all around us. The information we found was quite interesting. We felt a bit sneaky looking at our neighbors’ property values.

After compiling an extensive list of houses with relatively similar lot size and square footage, we sent in the appeal form—also available online—and requested a meeting with the assessor.

If you don’t have Internet access, most public libraries provide it at no charge.

Related Article: How to Get Free Wifi

A quick phone call to your county assessor’s office will let you know if their records are accessible online.

The County Assessor Turned Us Down

Having never done this before, we didn’t know what to expect. We figured that the assessor would be dazzled with our voluminous research, our reasoning ability, and convinced by our compelling arguments. NOT!

He got right to business and “matter-of-factly” turned us down. We concluded that if day-in and day-out he heard people complain about being overtaxed, he probably developed a pretty calloused attitude. Argh.

Well, we didn’t give up.

Beyond our contention that the comparable values of houses in our area where off, we had two measurable arguments.

The Atrium: The first one was that we have a 100-square-foot atrium in the middle of our home. This atrium is surrounded by glass and has an open roof, it is definitely not “livable square footage” in Arizona.

The Swimming Pool: The second was the size of our swimming pool. Steve had measured and diagrammed the pool and determined that the actual square footage of the pool was roughly half of what the assessor had listed.

Given those two discrepancies, we requested a re-measure of our home. The assessor agreed and submitted the paperwork for us.

Do You Have Un-permitted Improvements?

One caution before we proceed. Our home was built in 1978 and has undergone no additions or major renovations beyond the installation of plumbing for natural gas. For this, we obtained a permit.

The only other major project we have done is the remodeling of our kitchen, for which no permit was required.

If you know that you have un-permitted/undocumented improvements on your home, contesting your assessment may result in an increase in taxes, instead of a reduction.

The County Assessor Visit

We were told that it would take six weeks before the assessor could visit us. About one week later, after our face-to-face meeting, we received a phone call from “John,” the person we met with, saying he was in the area and wanted to stop by and measure. We turned him down; it wasn’t a convenient time for us.

It seems that surprise is one of the tactics they use to throw people off guard.

We tried to set a firm date, but he declined. We continued to receive phone calls from him, usually giving us a one-hour notice. Finally, we gave in.

The Floor Plans Originally Submitted Didn’t Exist

When John showed up to measure, Steve stayed with him the whole time. He came equipped with a diagram and measurements that the county used to assess our home. As they walked, talked and measured, it became very clear that the information the custom builder had provided the county back in 1978 was different than what had actually been built.

One side of our house was nine feet shorter than the diagram represented. The atrium inside our home was non-existent, and there were several other measurements that were inaccurate.

John the assessor was puzzled and amazed. “I’ve never seen measurements off by this much,” he said. He left and told us that he’d call in a few days.

If you have purchased a custom-built home, there is a very good chance that the floor plan that was originally submitted for construction, is very different from what actually got built.

So if you want a money-saving project to do, this could be a money-maker for you!

The County Assessor called as promised but said that he wanted to re-re-measure. The numbers were off so much he thought that he must have made a mistake. Later he confided that he was hesitant to present such drastically different measurements to his supervisor without being one-hundred-percent sure.

So, we measured again and came up with the same number. Boy, were we excited! Our taxes were going down . . . waaay down . . . or so we thought!

How Does the Property Tax Appeal Really Work?

Little did we know that the easy part was over. When we appealed the assessor’s denial and requested the re-measure, the appeal went to a different county department, the board of equalization. They basically take the recommendations of the assessor and either allow or deny valuation changes.

After the errors were determined, the assessor’s office said they could make the change to our valuation so we didn’t need to go to the board of equalization. But when Steve called the board, he was told that the assessor didn’t have the authority to authorize any changes to our assessed value.

Whom should we believe?

We discovered that, as with so many things in government, the right hand didn’t know what the left hand was doing.

After numerous phone calls to different people in each department and a lawyer friend or two, Steve was finally able to piece together the warped scenario.

The Role of the Board of Equalization

Because of the high number of valuation appeals, regulations had been enacted to streamline to process and reduce the caseload on the board of equalization. The assessor’s office is allowed to make changes to what they consider indisputable facts.

If the measurement is off, they can change it and not bother the board. The board of equalizations staff didn’t realize that this was permissible. They thought that they possessed “all knowledge and power.”

In the end, the board did need to approve the valuation change for future years, but the assessor’s office was responsible for getting us a refund for previous years. That’s right, we received payments for three prior years.

The Property Tax Appeal Resolution

This convoluted tale has somewhat of a happy ending. We won our property tax battle and received three years’ worth of refunds. Our taxes were reduced $270 per year for . . . about three weeks.

Then a new tax bill arrived with an updated valuation. We should have been grateful that our tax bill didn’t go up the $250 it was originally supposed to. Ultimately, our tax bill was $20 less than the previous year. So much for the big savings.

In total, we spent 30 hours researching, arguing, questioning, and fighting. Was it worth it? Well, yes and no.

We figured that we earned about $36 per hour. When you divide our first-year savings ($270) plus our three years of refunds ($810) by the number of hours spent (30).

But beyond that, we have the emotional satisfaction that we stood up to the “Empire” and won.

Freezing Property Values for Seniors

If you are of retirement age, check with your county assessor to see if there are any special laws regarding your property taxes. In our area, seniors can request that their primary residence property taxes be frozen. There are other stipulations, but it never hurts to ask the question.

RELATED ARTICLES:

– How Frugal Living Helps You Retire Early

– Best Retirement Gifts: Frugal, Fun & Decadent

If you are looking for help, there are companies that will contest your property taxes for you. Do your research and ask many questions. You may find that their services are not targeted for the individual homeowner. They usually focus on apartment complex owners, commercial real estate owners, and other large property owners.

We may be bruised and battle-weary, but we won. Now we can stand before you and attest to the fact that the savings can be had, but the mental and emotional price may be high.

If you have the time and the inclination to embark on this epic journey, don’t plan on doing much else during that same time.

Related Article: How We Paid Off Our Mortgage in 9 Years

Cautions for a Property Tax Appeal

This process shouldn’t be undertaken if you’re pregnant, thinking about getting pregnant or know someone who knows someone who’s pregnant. Caution should be taken if you have heart problems, back problems or even a hangnail.

Consult your physician, local clergy or psychiatrist before challenging any government bureaucracy.

TAXES ARE TAXING

Something to smile about as you prepare and pay your taxes this year.

“I’m proud to be paying taxes in the United States. The only thing is, I could be just as proud . . . for half the money.”

– Arthur Godfrey

“I hear a good deal of talk from Washington about lowering taxes. I hope they do get ‘em lowered enough so people can afford to pay ‘em.”

– Will Rogers

“We contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle.”

-Winston Churchill

“A fine is a tax for breaking the law; a tax is a fine for obeying the law.”

– J.H. Goldfuss

“The only difference between a tax man and a taxidermist is that the taxidermist leaves the skin.”

-Mark Twain

For more great money-saving tips for your home, visit the money-saving tips area of our website, under the housing/ home repair section.

Also, check out these articles on this subject at Bankrate.