Buying a home with bad credit can really be challenging. And if you have a poor credit score it can be even tougher. If you’ve always dreamed of owning a home, but you’re struggling with saving a down payment or raising your credit score, we’ve got hope.

There are several steps you can take to repair credit, find a lender, and realize that goal of homeownership. This guide will help you find all the resources you need.

Step One: Work on Your Credit

TABLE OF CONTENTS

- 1 Step One: Work on Your Credit

- 2 Step Two: Start Saving for Your Down Payment

- 3 Step Three: Research Low Credit Score Lenders

- 4 Step Four: Get Pre-Approved for a Home Loan

- 5 Step Five: Buying a Home – The House Hunting Process

- 6 Programs for First Time Home Buyers

- 7 The Family Emergency Binder

- 8 Keep Up the Good Work on Improving Your Credit

- 9 More Resources for Buying a Home with Bad Credit

Bad credit and a low credit score are major obstacles when purchasing a home. Lenders use your credit score to determine what kind of risk you are as a borrower.

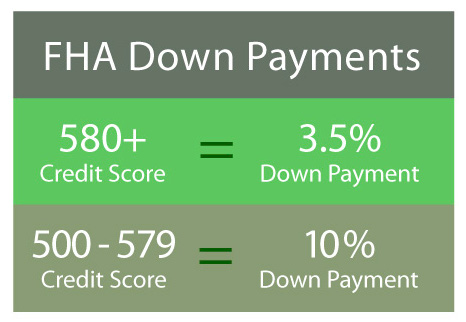

Your credit score will also be a guide for how much down payment may be required for the home you’d like to purchase.

Most lenders will have set minimums to offset their risks, but the chart below gives a good example of what to expect.

Credit scores range from 300 to 850. In general, a score of 700 or more is considered good credit. The good and bad categories can be further broken down as follows:

- Excellent is 750 and higher

- Good is 700-749

- Fair is 650-699

- Poor is 600-649

- Bad is below 600

Check Your Credit Score

The first thing you’ll want to do is check your credit score to assess your financial health. Credit scores are calculated in a number of different ways, but here are some common factors.

The top five things that contribute to your credit score are:

- Paying your bills on time — no late payments

- How long you’ve had established credit — don’t close older, unused accounts

- The number of cards you’ve opened/applied for in the past 12 months

- Having a variety of credit such as store cards, car loan, student loans etc.

- Keeping your credit utilization at 30% or lower

~ Calculate by dividing total amounts owed by the total credit limit

~ Lower it by using less credit or by asking for an increase of your credit limit

Credit scores can change frequently according to the above factors. However, this can actually work in your favor. Make a decision to improve your credit today; with consistent effort, it won’t take long to see positive changes.

Get a free credit score and report card from Credit Sesame.

RELATED SAVINGS: Get your credit score for free from Credit Sesame

(no credit card required)

How to Raise Your Credit

The best way to overcome bad credit and to start raising your credit score is to make every monthly payment on time. This includes:

- Credit cards

- Mortgage or rental payments

- Utility bills

- Car loans

- Student loans

Late payments account for the biggest bad marks against your credit score.

Pay down current credit card debt as quickly as possible. Lenders look carefully at the ratio of debt you owe to the income you bring in. The more you pay off in credit debt, the higher your score will climb.

While paying off credit cards, don’t close any older accounts. A longer credit history contributes to a higher score.

Don’t open any new credit card accounts. Each credit card company looks into your credit report to find out what kind of risk you are. These inquiries can actually hurt your credit score for several months.

This video from our friend Josepeh Hogue will give you some excellent tips on increasing your credit score:

Your Credit Report

A credit report is different from a credit score. It is wise to review your full credit report at least once a year to see if it is accurate.

Your report is a summary of personal and financial activity including:

- Mortgages and other loans in your name and any late payments

- Your credit cards, balances, any defaulted payments

- Any records of collections you’ve been involved in

- Bankruptcies, liens, divorce, etc.

A credit report can contain errors such as:

- Name misspellings

- Inaccurate information due to similar or common names

- Complete misinformation caused by identity theft

- Incorrect information regarding late payments/collections

- Closed accounts listed as open

Always read your report thoroughly and take note of anything that’s out of place. Your credit score depends on accurate information.

According to the Fair Credit Reporting Act, every person is entitled to accurate, fair, and private reporting of their financial information. Errors on your credit report can be disputed and corrected.

If you find errors on your credit report and they result in a bad credit score read the next section on fixing the errors

How to Fix Credit Report Errors

If you find an error on your report, you’ll want to dispute it with both the reporting agency and the company/person who inaccurately furnished the information (bank, landlord, loan establishment, etc.).

There are three credit reporting agencies in the U.S.

Start by sending a written dispute to the agency that provided your report. Highlight or circle the errors you found, and include copies of financial documents to support your claim. Do not send originals.

Credit reporting agencies must review disputes within 30 days as well as report any confirmed errors to the original source of misinformation.

Credit Repair Focus Areas

If you’ve had some bad credit marks and want to clean up errors from any of the following situations it will take some work.

Do your research and know your rights. Armed with this knowledge, you should be able to get your credit cleaned up. Especially in the situation listed below.

Deployed Military: If creditors filed claims while you were deployed there are legal ways to resolve these issues. If you were or are on active duty – you may find help from the Servicemembers Civil Relief Act (SCRA).

Get more details in this YouTube video.

Divorce: If you’ve been divorced and there are dings on your credit report as a result of your ex-spouse’s spending, these may be legally removed.

Get more details in this YouTube video.

Student Loans: You may need help cleaning errors from student loan reporting

Get more details in this YouTube video.

Medical Expenses: They can address your situation with customized letters and challenges tailored to your specific medical issues.

Get more details in this YouTube video.

Credit Card Debts: Getting errors on your credit report removed is something they can be trusted to do.

Get more details in this YouTube video.

Step Two: Start Saving for Your Down Payment

After repairing bad credit, the next best thing to do when preparing for a home purchase is to boost your savings. The more you have saved, the lower the interest rate on your home loan.

Try for a goal of at least 10% of the purchase price as a down payment. While this may seem an overwhelming goal, you can reach it if you start saving a little from each paycheck.

Your Savings Account

The larger your savings account and dedicated down payment, the more likely you’ll qualify for a loan with a lower interest rate.

Lenders may use the amount of your savings to judge the risk of loaning you money. The higher your bank balance, the more likely you’ll pay your bills if you have a change of income or job loss.

To make the most of your savings, CIT Bank offers several high-yield plans to fit your long or short-term goals. They’re FDIC insured, and their high-interest money market accounts only require $100 to get started.

Also, consider opening a dedicated down payment CD to help with your down payment savings goals. CIT Bank offers CD savings with interest up to 2% APY.

Related Article: How To Building an Emergency Fund

Down Payment Facts

- A larger down payment usually results in a lower interest rate

- To avoid an extra PMI payment with your mortgage, you need 20% down

- A higher down payment means less risk for the lender

- Some loans require as little as 1-3% down

- There are loans that don’t require a down payment (more details coming up)

Private Mortgage Insurance (PMI)

Saving for a 10% down payment on a house is a great goal for most home buyers. However, anything below 20% comes with a price.

When a borrower can’t provide a 20% down payment, most lenders require the purchase of private mortgage insurance (PMI). Lenders use this insurance as a safety net in case buyers default on their payments.

Saving a larger down payment is one of the best ways for someone with bad credit to get a mortgage and buy their first or second home.

PMI can be canceled once the amount of the loan reaches 80% of the home’s original value. This is calculated by dividing the current loan balance by your home’s estimated value. Learn more about PMI from Bankrate.com.

Step Three: Research Low Credit Score Lenders

You’ve been working on your credit score and increased your savings. Now it’s time to shop for a loan. Fortunately, there are a few loan options available to buyers with low credit scores or bad credit.

The FHA Loan Option

An FHA loan is insured by the Federal Housing Administration. Lenders who are FHA-approved can offer loans with low qualification requirements. The government ensures the mortgage if the borrower can’t pay.

If you have bad or poor credit this is a great option. The minimum credit score is only 500.

FHA Loan Facts:

- The minimum credit score to qualify is 500 and requires 10% down payment

- Scores of 580 or higher require only 3.5% down payment

- FHA loans have relatively competitive interest rates

- Closing and other loan processing fees are minimal

- Must go through an FHA-approved lender

- Requires a home appraisal to ensure safety and basic living standards

- A two-year work history is strongly recommended (can be with different employers)

- Lenders will verify your reported income with your tax records

- Most recent year of credit activity will be evaluated

~ Make sure all monthly payments have been made on time

~ Don’t open any new lines of credit/credit cards during this time

- Buyers must purchase/pay mortgage insurance for the life of the loan

~ There is an upfront premium payment of 1.75% of the loan amount due at closing

~ Monthly insurance payments range from 0.45% – 1.05% of the loan amount

Learn more about FHA loans from HUD.gov

The VA Loan Option

VA loans are a great option for veterans and their families. These loans are insured by the U.S. Department of Veterans Affairs and are offered through approved lenders.

VA Loan Facts:

No down payment required

- Lower interest rates than conventional loans

- No established credit limit; lenders may have some requirements

- Need proof of sufficient income

- The home must be used as the primary residence

- Lenders may evaluate recent payment history, credit behavior, and your debt-to-income ratio (preference of 40% or less)

- VA loans do not require mortgage insurance

- The borrower pays a one-time funding fee — amount dependent on

- Length of service

- Amount of down payment, if any

- Whether this is your first VA loan or if you’ve had one before

- This loan has service eligibility requirements.

Get more details on VA Loans on VA.gov.

Private Lenders for Bad Credit Score Borrowers

While this may be a common and acceptable option in the financial world, at MoneySmartFamily we don’t recommend this option. The cost is too high and the risk too great. Be patient, build your savings for a down payment and seek other lending options.

Another option for a home loan is to go through a private lender. These are not traditional loan institutions or banks. Private lenders include businesses, investors, or acquaintances.

In a private loan situation, it is very important to shop around. Consider loan interest rates, borrowing requirements, and the integrity of the lender. You may want to consult with an attorney before signing on for a private loan.

Private Loan Facts:

- Often called Hard Money Loans; they’re expensive and can be risky

- Interest rates can be very high

- Often short term — mostly from 1-5 years

- May require collateral to minimize risk if you can’t make payments

- Low credit scores are often approved

- Qualifications vary depending on the lender

- May require up to 30% down payment

- Often has a quick approval process

- Expect higher fees and closing costs

Choosing the Right Lender

Low credit may limit your borrowing options, but you’ll definitely want to find a reputable lender to work with.

When deciding on a loan, do thorough research, get recommendations, and seek legal advice when necessary. Shop around for the right lender, and compare the following:

- Loan interest rates

- Loan origination fees

- Courier Fees

- Appraisal requirements/fees

- Document preparation fees

- Title search/insurance costs

- Escrow charges

- Closing costs

Get more information about finding the best mortgage lenders at Bankrate.com.

Step Four: Get Pre-Approved for a Home Loan

Homebuyers should never jump into house hunting before getting a loan pre-approval. It’s wise to know what the purchasing budget is before getting your heart set on something you can’t afford.

Benefits of Loan Pre-Approval

- Most sellers only accept bids from pre-approved buyers

- It speeds up the purchasing process

- Exposes unexpected credit or financial issues to prevent surprises at purchase time

- A pre-approval gives you accurate information about how much house you can buy

Many financial factors are evaluated during loan pre-approval. Most lenders have their own requirements. Low credit loans such as FHA and VA will have specific guidelines as well.

We NEVER recommend borrowing the full amount a lender says you qualify for. Our borrowing philosophy is to “Borrow as little as possible and pay it off as quickly as possible.”

Basic Documents Needed

- Proper ID

- Social security card

- Proof of residence

- Bank statements

- Proof of employment and proof of income (usually two most recent pay stubs)

- Previous two years of tax filing documents and W-2 forms

- Documentation of your monthly bills

- Credit information including cards, loans, etc.

- You may need information regarding bankruptcy and divorce situations as well

What Lenders are Looking For (not all-inclusive)

- A decent credit score and timely payments made on all monthly bills

- Low debt-to-income ratio — determines if you can afford a mortgage payment (divide your total monthly debt by gross monthly income)

- Steady monthly income — usually two years at the same company or same industry

- No new lines of credit opened in the past year or excessive balances

- A down payment of at least 10% for most loans

- Healthy savings account

Step Five: Buying a Home – The House Hunting Process

Your home buying experience should begin with a qualified real estate agent. The best agents are the ones who come highly recommended. You should also consider the following:

- Licensed with at least five years of experience in the area

- Prompt with communication and returned calls

- Available for your needs at the time of your house search

- Clearly defined commission structure and contract details

- Your personalities are a good match (don’t be afraid to interview more than one)

Look at a Variety of Houses in Various Conditions

Don’t be afraid to explore unconventional options when looking for your dream house. If you keep an open mind and have an eye for bargains, your perfect home could be a diamond in the rough.

Consider a Buying A Foreclosure or REO Home

Foreclosure properties in a good area are worth considering if they’re in relatively good shape. Be cautious about foreclosure houses, and always get a reputable inspector to verify the condition.

A good inspection will let you know of potential problems. Knowing the issues, you can set your budget for repairs.

Pre-foreclosure properties can save you a bundle, and they’re a safer bet than regular foreclosures. Current homeowners are normally still in residence, and there’s a much better chance the home is in decent condition.

REO properties are homes that didn’t sell at auction and are now real estate owned. The lender who holds the loan is usually very motivated to sell.

REO houses may offer more security than a foreclosure since they’re usually cleared of liens and back-taxes.

Real-Life Story: Steve & Annette from MoneySmartFamily.com purchased their first home as a bank repo. Their closing costs were minimal and the mortgage rate was 2 points below the prevailing rate. Because of the discounted price and the great financing they were able to pay off their mortgage in 9 years. link:

HUD Housing Options

The U.S. Department of Housing and Urban Development (HUD) often sells their own foreclosure properties. Find a HUD broker or HUD-approved real estate agent if you’d like to explore this option.

HUD housing can be a real bargain since real estate agent fees are paid by HUD itself. They also pay up to 5% of the closing costs. HUD homes are sold through a bidding process and are sold as-is. Always get a professional home inspection before purchase.

Real-Life Story: Steve & Annette’s daughter and her husband Collin purchased a HUD home in 2016. It was priced well below market value. It did need a good cleaning and a coat of paint inside and some repairs to the heating system and swimming pool. Despite these issues, it was a very good deal.

Consider Fixer-Uppers

The worst house in a great neighborhood could be the deal of the century. If you’re patient and undaunted by hard work (or lengthy construction), a fixer may be just your thing.

The benefits of a fixer include:

- A bargain price tag

- Usually less competitive

- You can customize it to your liking

- There is usually great resale value

Fixer-Uppers may need several types of inspections. Have certified inspectors check the roof, structure, wiring, plumbing, and other major systems.

Programs for First Time Home Buyers

If you’re a first-time homebuyer, there are several programs that can help with home purchase costs. With a little research, these programs could save you a bundle.

Government Assistance Programs

There are government assistance programs for new home buyers in nearly every state. Some programs provide help with down payments in the form of grants or low-interest loans.

Many grants don’t need to be repaid, and generous down payment loans may be available with interest as low as 1%.

There are several local programs that offer help for closing costs, renovation expenses, and emergency payment assistance.

Check with your local county, city, and state for specific resources available to you. Find a list of all states, and the local assistance programs offered, at HUD.com.

Qualifications for Government assistance may include:

- Proof of low income

- House may need program approval

- Approved property may be limited to certain locations

- May require loan pre-approval before applying

- Could require a small down payment/some closing costs

The Family Emergency Binder

Organize your family’s most important information – from finances to traditions to bedtime stories – so you’re prepared, no matter what happens.

The link below will take you to the EmergencyBinders.com website – an affiliate of MoneySmartFamily.com

Other Housing Loan Programs Include:

- USDA Loans for rural areas

- HUD’s Good Neighbor Program – Designed for firefighters, police, teachers, and EMTs who live or serve the area where the home is.

- HomePath Loan From Fannie Mae or Freddie Mac

Programs for Home Buyers With Poor Credit or Low Income

Operation Hope is committed to helping people with low credit or income realize the dream of homeownership. They currently offer assistance in 21 states.

Each person begins with a home buyer’s workshop and partners with a dedicated counselor. Operation Hope connects buyers with local resources needed to assist in a home purchase.

The National Council of State Housing Agencies is an excellent resource for first-time home buyers with poor credit. Each state has a housing finance agency (HFA) that may include:

– A variety of homeownership programs

– Access to low-interest loans

– Down payment assistance

– Low-income family housing

– Special needs housing

– Affordable mortgages

No Down Payment Options

The best option for a no-down payment purchase is the VA loan described in the low credit lenders section. They’re a great resource for veterans and their families.

Some credit unions and private lenders may also offer no down payment loans. Generally, this option is much harder to find than low-down payment programs.

No down payment options often come with miserable terms such as:

- Very high-interest rates

- Hard to qualify

- High closing costs

- High private mortgage insurance payments

First Time Home Buyer Tax Breaks

The federal first-time homebuyer tax credit has expired, but there are a few other tax breaks for homeowners to take advantage of.

First-time home buyers can apply for a Mortgage Credit Certificate. Buyers can offset their taxes with a portion of their mortgage interest payments made that year.

Qualifications may include:

- Must be first time buyers (or haven’t owned in previous 3 years)

- The home must be used as the primary residence

- Certain income and home purchase price restrictions may apply

Other Homeowner Tax Breaks

- Deduction on your yearly property taxes

- An energy tax credit may be available if energy-efficient improvements were made

- Homeowner tax breaks fluctuate from year to year — always check for current information during tax time

Keep Up the Good Work on Improving Your Credit

You can buy a home and reach your financial goals even with bad credit. Turning your finances around and finding the right loan takes determination and hard work, but walking through your own front door is priceless.

Whether you have bad credit or good credit, we always recommend that you use a money management system. Regularly monitoring and updating your budget will help you stay out of debt and to build savings.

If you’re interested in a non-computer option for budgeting, learn about America’s Cheapest Family Budget System. “Your budget will be a personalized, flexible tool that gives you financial confidence and freedom.”

More Resources for Buying a Home with Bad Credit

Get the budget system that allowed these homeowners to pay off their mortgage in only 9 years!

Read how Annette and Steve, America’s Money Smart Family, paid off their home in only 9 years on an income of $33,000 per year.

For more housing and mortgage resources, visit the Housing and Mortgage Tips and Tricks Page here.