A college graduate is starting Adulting. She asks what are the best things she can do to start living the adult life in a money smart way. The transition from being a student to becoming an adult can be a shock to the system.

Money Smart Adulting?

Hey there, Economides family:)

I am from Portugal and I love your tips. My birthday is coming soon and I will order your books as a gift.

Here life is a little different than in the U.S., but despite the distance, your concepts of living within your means is a great help!

I am an unemployed recent college graduate. I’m just now starting adulting and want to live money-smart and be debt-free! What do you recommend I do first?

How to Start Out Adult Living on the Right Foot

There are four things you can do to starting adulting in a money-smart way.

If you start your “adult” life by getting a job, avoiding debt and managing your income with some sort of budgeting system, and move slowly when it comes to buying things you need, you’ll soon have more money than you know what to do with.

1) Step One: Find a job, Any Job.

If it’s not the perfect job, work it anyway. And while you work, keep looking for a job that will use your education and your passion.

While you’re working this first job focus on being excellent and doing more than you’re paid for.

Og Mandino the author is the best selling book, The Greatest Salesman in the World,” said,

“Do more than you’re paid for and eventually you’ll be paid for more than you do.”

(Og was an international best-selling author, speaker and a personal friend of ours until his untimely death).

Volunteer or Intern

Another option is to work the first job you get and volunteer or intern at a company that is in the field you’re interested in. Having a work history is almost more important than having a great degree and a good GPA.

We always encourage college students to work hard to get internships while they are in school. According to NACE’s Student Survey (TheBalance Careers), sixty percent of college graduates who had paid internships in their senior year received job offers after graduation. Employers want to hire someone who knows how to work.

2) Keep your overhead low.

Once you get a job, be careful about taking on more and more monthly payments—like a car payment, buying a house, gym memberships and others. Save your money before you buy anything and pay cash.

Keeping your overhead low will save you money (interest) and allow you to build savings faster. There’s nothing wrong with driving an older car and wearing thrift store clothes. If you don’t have the money for a large purchase, wait and look for creative ways to meet the need.

We encourage people to utilize creativity rather than credit.

3) Set Savings Goals.

Even if you can only save a few dollars each week, do it. The discipline of protecting a few dollars will turn into 10, then 100, then 1000. Make goals to pay off debt, then to save for a car, a house, or any other thing. Watching slow and steady savings grow will become addictive.

We know you’re smart and even though you live in a different culture, the same rules apply. Cash is King, and managing your cash is the best way to build a kingdom that will last.

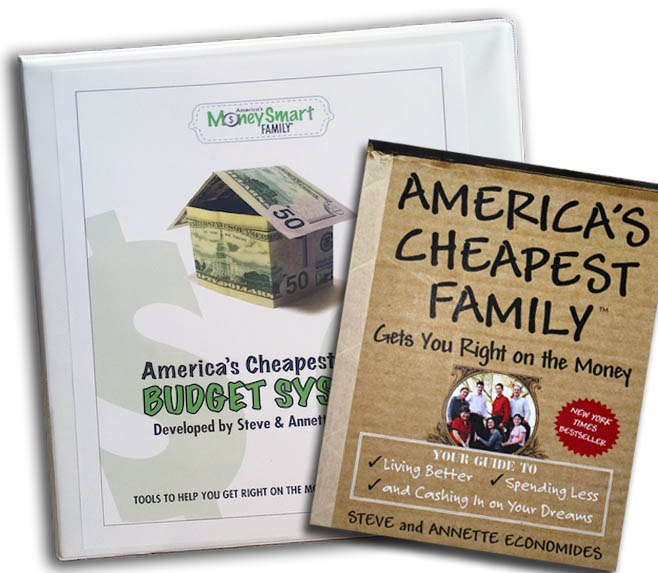

You may want to check out the budgeting chapter in our book, “America’s Cheapest Family Gets You Right on The Money, or our household budgeting system. Both could be a real benefit to getting your adult life started in the best ways possible.

4) Accumulate Things Slowly

Many college graduates are in a hurry to achieve their parent’s lifestyle, not realizing that it often too parents decades to accumulate the wealth and possessions they have.

Set a spending limit for each purchase and look for gently used things. There are so many people selling perfectly wonderful furniture, technology, cars and other necessities for someone starting out, that you should never have to pay retail.

Related Post: Sell & Buy Used Things

Just be patient and you’ll find everything you need — for a fraction of the price.

With patience, discipline and some creativity, you’ll start the adult life with more money in the bank, and a smile on your face.

If you’re interested in learning about the household budgeting system that we’ve used for many years, check out this page.

As you can see, MoneySmart Adulting isn’t going to be a quick thing. But with practice, it will become second nature and produce great dividends.