What is a financial windfall? Is managing a windfall something you are prepared to do?

Winning the lottery, a TV game show, a large inheritance or sweepstakes are all windfalls. What about smaller windfalls – like a tax refund? Have you ever been faced with managing sudden money?

How could this money help you? How would you manage it?

Have you ever thought of creating a plan for a financial windfall?

Will a Windfall be Coming Your Way?

What if you won the lottery? What would you do if you have $50 million dumped in your lap? Many of us would be able to quickly give an answer to that question.

Perhaps you would consider new houses for yourself and several family members. Or you’d take a major vacation around the world. Perhaps you’d even consider a little charitable giving.

Despite the unlikelihood of this type of situation, smaller “fortunes” that we fail to capture, come our way on a regular basis.

TABLE OF CONTENTS

- 1 Will a Windfall be Coming Your Way?

- 2 What Does a Financial Windfall Mean?

- 3 There Are Financial Windfalls Everywhere!

- 4 The Average $10,000 Windfall Response

- 5 What to Do Before the Financial Windfall Comes

- 6 Windfall Definition

- 7 Avoiding Windfall Disagreements

- 8 3 Windfall Management Plans

- 9 Where to Put Your Windfall

- 10 The Financial Windfall Hall of Fame

What Does a Financial Windfall Mean?

Windfall (noun)

Receiving unexpected good fortune, usually one that involves receiving money in a large. For example, Our company had “windfall profits” this last quarter.

Synonyms include jackpot, bonanza, manna from heaven, striking it rich, pennies from heaven, a stroke of luck, money dump, and a godsend.

“The inheritance we received from Uncle Martin was a windfall of epic proportions!”

There Are Financial Windfalls Everywhere!

Think about tax refunds, cash birthday gifts, overtime pay, bonuses, garage sale proceeds, stock dividends, and overcharges in your mortgage impound account.

These additional funds aren’t fairy tales or dreams, but financial “prizes” that can help you reach goals faster. Or they can throw you into depression if they are squandered or have to be used to catch up on bills.

Financial windfalls are extra money that can be timely but yet unexpected – and could happen suddenly. If you take a walk through last year’s bank account, you’ll find them sitting there, those wonderful little-unexpected bonuses.

Imagine what it would be like to open an envelope in the mail that contained a legitimate notification of a windfall.

What did you do with them? If you’re like most of us, they evaporated. And most likely went to catching up on bill paying, or decreasing debt, which is not a bad thing.

But have you considered that there can be a better way to handle a large sum of money that comes your way?

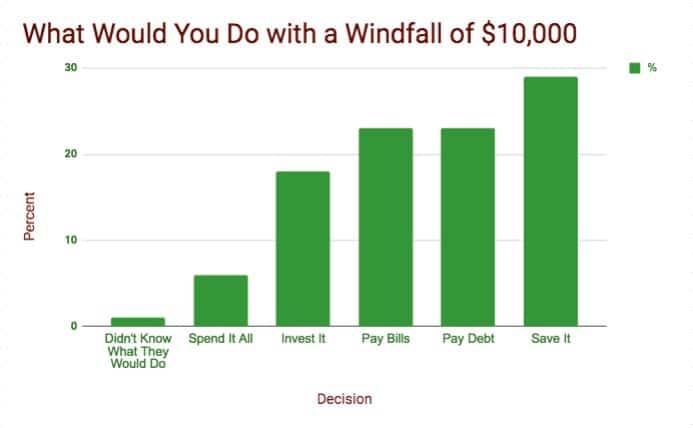

The Average $10,000 Windfall Response

According to a Bankrate.com article and an AllyBank survey here’s what most people would do if they received a $10,000 cash bonus.

- Didn’t Know What They Would Do (1 percent)

- Spend it all (6 percent)

- Invest it (18 percent)

- Pay Bills (23 percent)

- Pay Debt (23 percent)

- Save it (29 percent)

How would you answer the $10,000 question?

What to Do Before the Financial Windfall Comes

Years ago, we decided to stop letting the windfalls evaporate. We came up with a plan, a detailed agreement between the two of us. We specified how we would deal with any excess money, big or small, that came our way.

But before we get into the specifics of the plan we used, we’ve got to define how to tell when you truly have excess.

Do You Have a Spending Plan for Your Money?

We’ve always had a spending plan. It’s a system similar to the “envelope system” we use to teach our kids to manage money.

How We Manage our Money

Of course, our budget system is a bit more complex than theirs. We track our spending plan on paper while all the money actually resides in the bank.

We have categories for every regularly occurring expense. Nineteen different accounts cover categories such as Utilities, Food, Pets, and Gifts.

The balance in all the accounts, added together, equals the total in our checkbook. So, when we want to make a purchase, instead of consulting the larger balance of our checkbook, we review the smaller balance on the corresponding account sheet. If the money is there, we buy, if not, we wait.

The Benefits of a Spending Plan

The beauty of the spending plan is knowing that all our living expenses and savings goals are provided for. We know exactly what it takes to fund our monthly budget. Some accounts accumulate money for months without being spent, and others get used up every month.

Because we regularly update and consult our spending plan, we know when we really do have a windfall.

Windfall Definition

We consider a windfall to be extra money that can be spent outside of normal spending plan limits is celebrated. This kind of money truly is excess that can be used for what we call The Windfall Plan.

RELATED ARTICLE: Smart Things To Do With An Inheritance

Avoiding Windfall Disagreements

This is our standing joke. Whenever we’re out driving around and see a boat for sale, Steve will usually quip, “Honey, there it is, the boat I want to buy with our next windfall.”

He admits, “As a man, I seem to have an incurable ability to find all kinds of toys. And most of them are costly to maintain. It’s easy to find things to spend our money on.”

Author Larry Burkett observes that most women will overspend a bit on groceries or buy a few too many clothes, while their husbands will come home with a new TV, car, or boat.

Discussing What to do with Extra Money

After having a few extended “discussions” about different desires or goals for a specific windfall, we knew we needed to come up with a plan for the future.

We started out using a “wish list” where we both wrote things we would like to buy with any extra money. Then we discussed the items and came up with agreed-upon priorities.

While this system was better than not having any plan, the situation was still pretty stressful.

It’s hard to negotiate and be patient while the money is just sitting there in the bank waiting to be spent. We needed something better so we could really enjoy the benefits of the windfall and avoid marital conflict.

3 Windfall Management Plans

What we needed was a more proactive approach. So we developed a percentage plan before any more windfalls came into our possession. This proved to be much less stressful and increased our enjoyment level.

When we were paying off our first house, we came up with this windfall distribution plan. Whatever excess money came in would be divided into three categories.

We allocated 33% of every windfall to each of the following categories:

- An extra house payment;

- Additional Charitable giving;

- For Special Projects & Fun – buying stuff we wanted & playing with some.

We were debt-free except for the mortgage on our house. By using our windfall percentage plan, we paid it off in nine years.

Yes, we could have eliminated the special projects/fun portion of the plan and paid the house off faster. But we came to the conclusion that we needed to have some fun in the midst of working toward a sacrificial goal.

We knew that if we enjoyed a little of the money we would be more likely to stay the course and reach the goal.

It was truly amazing to see the mortgage principal amount plummet as we kept sending in the extra payments. We still remember preparing to make that last payment. There were several phone calls to the mortgage holder.

Finally, we set the final date and payment amount. We wrote the check and then cheered when the deed arrived in the mail! WOW, what a great feeling.

Start Your Financial Windfall Plan with These Ideas

So what might your plan look like? Of course, it’s different for every family, but you might consider the following if you’re liquidating debt:

- 60% to liquidating your smallest debt

- 20% to save (emergency funds to keep from using credit)

- 10% to charitable giving

- 10% to enjoy

Are you out of debt and paying off your house? Try the following windfall plan:

- 30% to additional principal

- 30% to save (emergency funds or IRA/retirement savings)

- 20% to home improvement projects

- 10% to charitable giving

- 10% to enjoy

Where to Put Your Windfall

We are not investment advisors, but we do know several. If you’re blessed with a large amount of unexpected money, don’t do anything quickly.

It is recommended to put the money into a Federally Insured high-interest account. CIT Bank is one option. They pay more than 2% for some of their accounts.

Once the money is safely deposited, start doing your research. We think a fiduciary, rather than an investment advisor is a better choice.

According to Investopedia, fiduciaries are bound by law to only operate in the best interest of their clients. They can’t recommend investments to you because they would receive a larger commission or fee.

No matter which route you go, take your time, get experienced counsel and enjoy the rewards.

The Financial Windfall Hall of Fame

Whatever your plan, spend some time thinking and talking about it. Come up with percentages that you can live with. Write down the plan and then apply it.

Remember that you can always fine-tune it if you’re not 100 percent satisfied. By taking these steps, you’ll join the many people we’ve seen enjoy windfalls.

They are members of our Windfall Hall of Fame. Here is a shortlist of some savvy people who learned a lot about managing windfalls.

Christmas Gift Windfall

A $500 Christmas gift came at the perfect time for a couple who had just started applying their spending plan and debt reduction strategies.

This windfall allowed them to buy a “new” used refrigerator (theirs was leaking), and reupholster their car. They also purchased some dress shoes and a suit for the husband so he could go out and interview for a new job.

The timing was ideal, they had agreed on the priorities and they enjoyed the results.

RELATED ARTICLE: Emergency Fund Examples

Side Hustle Windfall

In another instance, a pastor and his wife, with a very modest income, made a plan for their windfalls and within a few weeks received some unexpected money from a wedding he performed. They were in agreement about where the money should go and were really blessed.

Asset Liquidation Windfall

A divorcee we were coaching received $30,000 from the sale of a vineyard her ex-husband had sold. It allowed her to pay off the small balance on her mortgage, get completely out of debt and start an emergency fund.

Family Windfall

We were coaching a couple with four children and one on the way. They received $49,000 from the liquidation of an investment plan at the husband’s previous employer.

The business owner had been putting the money away for years and never told the employee.

This windfall required extra planning due to the tax liabilities and penalties. But it came at a time when they especially needed the money to expand their home and buy a larger car.

No matter what the amount, financial windfalls will come your way. And, having a spending plan and a windfall plan makes managing a windfall much more fun and profitable. Then enjoy the bonus of reaching goals and laughing all the way to the bank.

Editors’ Note: The 3-minute interview below describes our windfall plan in more detail.

RELATED ARTICLE: How I Managed a Financial Windfall

Visit our Pinterest Page and check out our budget/debt/savings board.

Also, visit our YouTube Channel and click on our Household Finance playlist and our Budgeting Tips Playlist.