Money Smart Family –

Making Frugal Fun

Originally known as America’s Cheapest Family in the Media, we’re sharing our MoneySmartFamily Lifestyle and Making Frugal FUN!

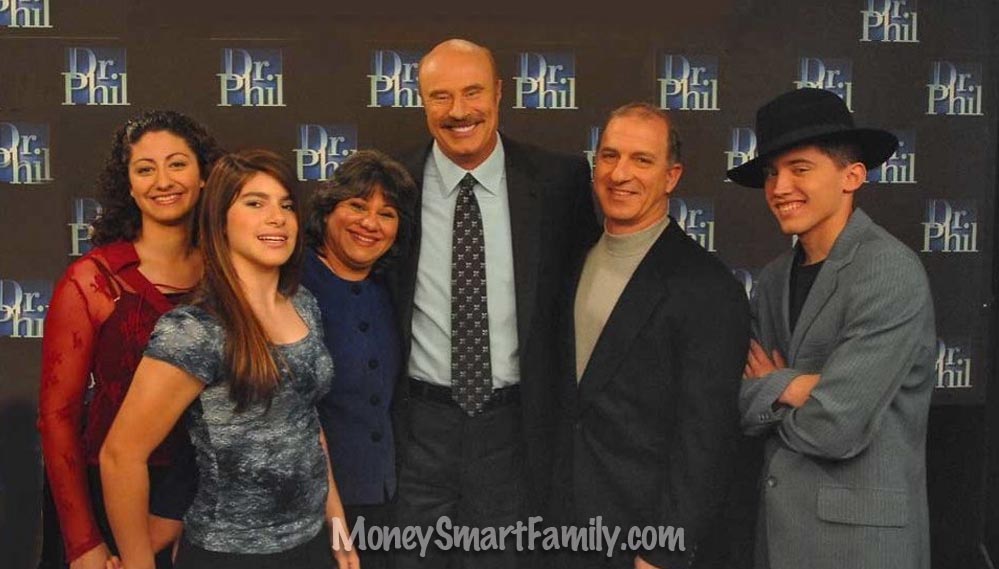

Steve & Annette have been Featured as Finance Experts on:

If you’re looking to improve your finances or want to change your entire relationship with money, we’re here to help you:

- Live Debt Free & Budget Your Money Better

- Save Tons of Money on Groceries

- Raise Independent MoneySmart Kids

3 Main Focuses of MoneySmartFamily.com

Thousands of people read our blog each month. Check out what was posted this week.

Other Popular Categories

About MoneySmartFamily

Steve & Annette Economides are NY Times Best Selling Authors of 3 books, YouTube Creators and Family Finance Experts. Learn more about their MoneySmartFamily

They’ve been called “America’s Cheapest Family,” “The First Family of Frugal,” “Cheapskates,” “Tightwads,” and several other names.

But what do you call someone who has:

- Paid cash for all their cars

- Paid their homes off in record time

- Never paid credit card interest

- Took debt-free vacations

- Fed a family of 7 for $350 per month?

We call that being a Money Smart Family. Learn how you can save money on everything, manage your money like a pro, cut your grocery bill in half and teach your kids to be money masters.

See MoneySmartFamily on the Today Show

Steve & Annette’s 3 Books