Is it possible to raise financially responsible children, of any age, in a society

filled with consumerism and entitlement?

The answer is YES!

And the answer is found in The MoneySmart Family System book!

The MoneySmart Family System

Winner of the Family Choice Award

for the Best Parenting Resouce of the Year!

This book was acclaimed as the Best Parenting Resource of 2012!

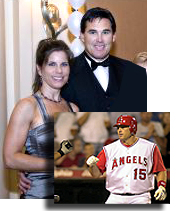

NY Times best-selling authors Steve and Annette Economides raised their five kids while spending 77 percent less than the USDA estimated. And the money they did spend was also used to train their children to become financially independent.

The MoneySmart Family System book will show you how to teach your children to manage money and have a good attitude while they’re learning to earn, budget and spend wisely.

In the MoneySmart Family System You’ll Learn How to:

- End the battle over clothing — forever.

- Teach your children to be grateful and generous.

- Inspire your kids to help with chores as a member of a winning team.

- Prepare your kids for their first paying job.

- Help your kids to pay for their own auto insurance

- Help them pay cash for cars.

- Employ strategies for debt-free college educations.

- Truly help your adult children when they want to move back home.

- Really help with your adult children when they ask for a bail-outs.

With clear steps for children of every age, The MoneySmart Family System book proves that it’s never too early, too late, or too hard to start learning financial responsibility.

ON THIS PAGE YOUR CAN ACCESS …

Bonus Chapters &

Author Q&A

- Resource Pages

- Q & A with Steve

& Annette

BUY a Copy of The MoneySmart Family System

BUY an Audiobook or eBook from Amazon

The MoneySmart Family System chapters include:

- The 5/50/500 Rule

- How We Raised Five MoneySmart Kids

- Morning: First Things First

- School: More Than Book Smart

- Chores: The Gateway to Productive Work

- Round-Up: A Neat Way to End the Day

- Giving and Sharing: The Blessings of Generosity

- Saving: Banking on Their Future

- Clothes Become a Money Tool

- Spending: Living with Limits

- Activities for Character, Strength, and Scholarships

- Playing and Paying: Toys, Recreation, and Technology

- Gifts and Gratefulness

- Miscellaneous Expenses: Essentials, Electives, and Extravagances

- To Work or Not to Work?

- Transportation: Getting Around

- Friends, Love, and Marriage

- College and Trade Schools

(largest chapter which could save you more than $40,000) - Bailouts: The $50,000 Boomerang

- MoneySmart Grandparents

- The Complete MoneySmart Family

PLUS 2 Bonus Chapters Online:

22. To The Mom

23. To The Dad

Plus Bonus Resources too:

- Tips for MoneySmart Grandparents

- The Kaiser Family Foundation; Electronic Media and the Youngest Kids

- Bailouts: How to truly help your young adult or adult children

- Dropouts: 111 men and women who made it big without a diploma

- Compound Interest: Two simple “games” to teach kids about interest

Steve & Annette were married in 1982 and have raised five money-smart kids. They currently live in Scottsdale, Arizona. All their children are grown, they are officially empty nesters and currently have 5 grandchildren.

Video and Audio Resources for the MoneySmart Family System

The MoneySmart Family System Book is Endorsed By

Read what the experts (and some everyday parents) think of

The MoneySmart Family System Book:

“Every parent or parent-to-be should read this book! Steve and Annette Economides have given concrete steps to teach your children financial responsibility and independence while making it fun as they learn. Adults can learn from this system too. A must-have for every family library shelf.”

—Dr. Laura Schlessinger, New York Times best-selling author and host of The Dr. Laura Program on SiriusXM

“Kudos, Steve and Annette, for another awesome winner! The MoneySmart Family System book is the perfect guide for strategies to help raise financially responsible children with skills to successfully deal with the uncertainties of adult life. Sixty percent of today’s parents are assisting their financially dependent kids, so this book could not be more timely. It’s a must-read and a must-take-action tool.”

—Glinda Bridgforth, a financial coach for Oprah’s Debt Diet and best-selling author of Girl, Get Your Money Straight

“Foreign aid to poor countries and overly generous parents produce the same outcomes: initially, thankful responses; then in short order, increasing expectations; and not long after that, an attitude of entitlement. The best way I can think of to break the iron law of entitlement is through financial independence by becoming money smart. There is a saying that we should leave a better country for our children. But it’s more important to leave better children to our country. The MoneySmart Family System book does all of this.”

—Dr. Barry Asmus, senior economist—National Center for Policy Analysis

“You’ve made a great choice! You can’t go wrong by following in the footsteps of Steve and Annette as they walk you through a comprehensible, practical, and fail-safe way of getting your kids financially ready to stand on their own. Bottom line—your family’s stock value will go way up by reading and applying this life-changing book.”

—Dr. Tim and Darcy Kimmel, authors of Grace-Based Parenting and Little House on the Freeway

“Steve and Annette’s tips, ideas, and how-to’s are useful no matter what your income level. All kids need to learn to be independent financially and emotionally and this book encourages you to be counter-culture. Their proven methods give you hope that your kids can and will be financially stable adults. Thank you, Steve and Annette, for your insight, discernment, and desire to share such wisdom. We’re anxious to get started with our own four kids!”

—Marci and Tim Salmon retired MLB player for the Los Angeles Angels

“Once again Steve and Annette Economides have done it. They’ve taken a complicated (and sometimes terrifying) subject and turned it into something that’s understandable for everyone. The MoneySmart Family System book is truly a work of love. It’s about family first and finances second. Unlike other books that rehash the common expert views, Steve and Annette provide logical, personal, and practical advice. Money dominates many family dynamics today, often with devastating results. If you want your family to have a healthy relationship with money and personal finances, you’ll want to use this book as your guide.”

—Gary Foreman, publisher of TheDollarStretcher.com

“The money-saving power couple has done it again. In their new book, Steve and Annette Economides deliver must-have advice on raising MoneySmart kids. They share their experiences, parent to parent, about what works and what doesn’t when trying to teach your children about finances. This book goes far beyond a discussion of chores and allowances. Steve and Annette offer their take on everything from kids’ TV watching and video gaming to buying a first car and attending college. Give your kids the tools they need to earn, save, spend, and give their way to success. Start with buying this MoneySmart Family System book.”

—Gregory Karp, author of Living Rich by Spending Smart and The 1-2-3 Money Plan

“The MoneySmart Family System book is just that—smart. Steve and Annette have been passing on financial principles to their children for years and now you can learn their secrets too. The next generation needs to know how to steward their money, time, and possessions in a way that makes God and their parents smile.”

—Howard Dayton, founder of Compass-Finances God’s Way and author of Your Money Counts

“Intentional parenting! Two words that best describe this book. Why let the uninvited voices of the world determine how your children view money? This book is a foundational tool that will allow you to speak to the lives of your children in a positive way by enabling them to take control of their finances. This will give them a head start in life by teaching them principles that will stand the test of time regardless of the world’s financial challenges.”

—Jeff Jones, drummer for Big Daddy Weave and founder of Customstix.com

“The MoneySmart Family System book is both insightful and right on the money! Excellent advice for families with kids of all ages.”

—John Rosemond, author of The Well-Behaved Child

“Steve and Annette provide insightful and meaningful skills for parents as they instruct their children to not just be money conscious, but develop character that will push them toward success in their future. I look forward to sharing many of these life skills with my girls as they grow up!”

—JJ Heller, singer/songwriter

“Steve and Annette Economides are American parenting heroes! Their latest book, The MoneySmart Family System, is magnificent. It is a beacon of hope for families. In it, moms, dads, and educators will discover several proven strategies on how practicing great money habits can transform the lives of people of all ages, regardless of their income, social or ethnic stratum. It’s a must-read.”

—Sam X Renick, author of It’s a Habit, Sammy Rabbit and founder of ItsAHabit.com

“For more than twenty years, my wife and I have seen how Steve and Annette Economides’s down-to-earth, creative, fun, and brilliantly wise lessons on money have blessed their own family and helped thousands of other families as well. At last, they’ve captured all those hard-earned nuggets and put them into a MoneySmart System Book that can help even the most out-of-balance parents finally know how to raise MoneySmart kids. You will love this book’s authenticity, practicality, humor, and “Why didn’t I think of that?” reality. Most of all, this book will make you a hero in your kids’ eyes—particularly when they grow up being self-supportive, positive, happy adults who aren’t afraid of a changing, challenging future. Buying, reading, and applying this book is that rare, incredible investment that can absolutely protect, encourage, and “bless” your child—and you.”

—John Trent, Ph.D., author of the million-selling parenting book The Blessingand president of StrongFamilies.com

Q&A with the Authors of The MoneySmart Family System

- Why do you think chores are an important part of childhood?

- Chores are the gateway to a productive adulthood. Starting at three years old, children can help with tasks around the house and those tasks can be used to teach them real world working principles of diligence, timeliness, thoroughness and following instructions. Chores prepare a youngster to live independently.

- Chores are the gateway to a productive adulthood. Starting at three years old, children can help with tasks around the house and those tasks can be used to teach them real world working principles of diligence, timeliness, thoroughness and following instructions. Chores prepare a youngster to live independently.

- How do you teach your children to be grateful and generous?

- Gratefulness comes as a result of having a desire fulfilled after waiting for it—basically delayed gratification satisfied. When children are indulged with lots of material possessions and never feel a need for anything they are cheated out of learning gratitude and basically become “spoiled brats.” We allowed our kids to wait for good things and helped them express their gratitude through writing thank you notes.

- Gratefulness comes as a result of having a desire fulfilled after waiting for it—basically delayed gratification satisfied. When children are indulged with lots of material possessions and never feel a need for anything they are cheated out of learning gratitude and basically become “spoiled brats.” We allowed our kids to wait for good things and helped them express their gratitude through writing thank you notes.

- Why allowances don’t work.

- Allowances don’t work for the same reason that government entitlement programs don’t work. Paying someone for doing nothing produces . . . nothing. Many parents spend gobs of money on their kids or repeatedly give them cash to spend but it’s so much better to allow them to earn the money from you and learn to manage it. They’ll develop a sense of pride and self-sufficiency, instead of a sense of entitlement and selfishness.

- Allowances don’t work for the same reason that government entitlement programs don’t work. Paying someone for doing nothing produces . . . nothing. Many parents spend gobs of money on their kids or repeatedly give them cash to spend but it’s so much better to allow them to earn the money from you and learn to manage it. They’ll develop a sense of pride and self-sufficiency, instead of a sense of entitlement and selfishness.

- At what age do your kids start buying their own clothes and why?

- In our MoneySmart Kids system, initially our kids are responsible for dividing up any money they earn into three categories: Giving, Saving and Spending. Between the ages of 9 and 11 we give them a raise and the additional responsibility of purchasing all of their own clothing. It’s a real world responsibility and they love shouldering it, and wearing it.

- In our MoneySmart Kids system, initially our kids are responsible for dividing up any money they earn into three categories: Giving, Saving and Spending. Between the ages of 9 and 11 we give them a raise and the additional responsibility of purchasing all of their own clothing. It’s a real world responsibility and they love shouldering it, and wearing it.

- How much does it cost to raise a MoneySmart Kid?

- The USDA calculates that it will cost the average parent $261,000 to raise a child from infancy to the age of 17. We calculated that it cost us 77 percent less than the USDA experts predicted.

- The USDA calculates that it will cost the average parent $261,000 to raise a child from infancy to the age of 17. We calculated that it cost us 77 percent less than the USDA experts predicted.

- What miscellaneous expenses should children be responsible for?

- As kids grow, their “wanters” are programmed to crave the latest and greatest of everything—things like trendy toys, extreme recreational activities, the latest techno-devices, costly cosmetics, and sporty sunglasses. When our kids use their own money to make discretionary purchases they have a deeper sense of appreciation and take much better care of the item.

- As kids grow, their “wanters” are programmed to crave the latest and greatest of everything—things like trendy toys, extreme recreational activities, the latest techno-devices, costly cosmetics, and sporty sunglasses. When our kids use their own money to make discretionary purchases they have a deeper sense of appreciation and take much better care of the item.

- Why do you think that every teen ought to work a part time job?

- Every adult has to juggle numerous roles; employee, boss, parent, spouse, child etc. Allowing our teens to think that living at home while going to school is their only job is totally unrealistic. Learning to balance the priorities of work, school, extracurricular activities and relationships are all things a maturing young adult must be taught to manage. Allowing our kids to start this learning process while they’re still at home is much more beneficial than simply pushing them out of the nest and expecting them to fly.

- Every adult has to juggle numerous roles; employee, boss, parent, spouse, child etc. Allowing our teens to think that living at home while going to school is their only job is totally unrealistic. Learning to balance the priorities of work, school, extracurricular activities and relationships are all things a maturing young adult must be taught to manage. Allowing our kids to start this learning process while they’re still at home is much more beneficial than simply pushing them out of the nest and expecting them to fly.

- Why shouldn’t you buy your child a car?

- Parents shouldn’t buy their kids cars because it robs them of the opportunity to set, save and reach a monumental goal on their own. Financial independence is a muscle that needs to be strengthened one dollar and one goal at a time. For our kids, as they matured and grew more capable in their money handling skills, buying a car was a natural outgrowth.

- Parents shouldn’t buy their kids cars because it robs them of the opportunity to set, save and reach a monumental goal on their own. Financial independence is a muscle that needs to be strengthened one dollar and one goal at a time. For our kids, as they matured and grew more capable in their money handling skills, buying a car was a natural outgrowth.

- Can kids earn a college education without debt?

- Scholarships are plentiful and aren’t only for academic excellence. You’ll learn how we helped our kids build great high school resumes that enabled them to win lots of scholarship money and opened many university doors.

- Scholarships are plentiful and aren’t only for academic excellence. You’ll learn how we helped our kids build great high school resumes that enabled them to win lots of scholarship money and opened many university doors.

- How should you respond to your adult children when they need help with a financial problem?

- When adult children experience financial problems, parents must respond with practical ways to help them grow financially. A cash bailout is like applying a band-aid to a broken leg—it simply doesn’t solve the problem. Families should be a safety net for their grown kids, but not a crutch.

- When adult children experience financial problems, parents must respond with practical ways to help them grow financially. A cash bailout is like applying a band-aid to a broken leg—it simply doesn’t solve the problem. Families should be a safety net for their grown kids, but not a crutch.

- What is the rich kid syndrome and why should parents be concerned?

- Parents who indulge their children handicap them for life. Many well-meaning parents are creating financially co-dependent children by giving them material things or money, instead of teaching them to work for what they want. The Rich kid syndrome builds unrealistic expectations in young adults and can destroy marriages and families. MoneySmart parents enable their children to live on their own earnings, not theirs.

- Parents who indulge their children handicap them for life. Many well-meaning parents are creating financially co-dependent children by giving them material things or money, instead of teaching them to work for what they want. The Rich kid syndrome builds unrealistic expectations in young adults and can destroy marriages and families. MoneySmart parents enable their children to live on their own earnings, not theirs.

- What is the 5/50/500 Rule and why is it important?

- The 5/50/500 money rule describes the escalating cost of a lesson that goes unlearned. Every age and stage of a child’s growth comes with expectations. If parents don’t learn how to train their children to stand financially independent at the $5 stage of life, they will be destined to fund an unending stream of $5 child demanded items until the price escalates to $50, then $500 and then $5000. The MoneySmart Family System teaches parents how to stop the consequences of the 5/50/500 rule.

- The 5/50/500 money rule describes the escalating cost of a lesson that goes unlearned. Every age and stage of a child’s growth comes with expectations. If parents don’t learn how to train their children to stand financially independent at the $5 stage of life, they will be destined to fund an unending stream of $5 child demanded items until the price escalates to $50, then $500 and then $5000. The MoneySmart Family System teaches parents how to stop the consequences of the 5/50/500 rule.

- What is the MoneySmart Family System?

- It’s what we’ve used to train our five kids to be financially responsible and independent. We start at a young age, teaching them to earn, save and spend their own money. At age eleven they start buying their own clothes. They buy Christmas gifts for others, pay for their own auto insurance, pay cash for their own cars and fund much of their own college educations. Initially they earn money from us, and are responsible for managing it so that they can buy the things they need and want. Eventually they get a part time job and learn to manage even greater amounts of money. Because of our MoneySmart Family system, when they leave home, they have a practical working knowledge of personal finances and can survive in the real world, debt-free and without bailouts from us.