Are you ready to learn about an amazingly easy budget-tracking tool? It’s the most unexpected, simple, and amazing key to an effective household budget ever!

We’ve got Budget Tracking secrets to help you become successful financially.

Lots of people talk about household budgets at the beginning of the year. With the holidays quickly fading in the rearview mirror, we’re motoring at full speed into a new year, full of optimism and powered by new resolutions. While some cruise down that road with apparent effortlessness, others will hit speed bumps or have collisions with unseen obstacles. The road to resolution heaven is often littered with derailed dreams.

But with the current pandemic, layoffs, shelter-at-home orders, and lots of other financial stressors, a budget is the best tool to survive these times.

What if there was a way to virtually guarantee that you could reach your money management goals: getting out of debt, increasing your savings, investing for retirement, or finally setting up a budget that really worked?

Is there actually a road to financial hope paved by scores of people who have gone before you? What if those people had a secret, a key that helped them to manage their money and navigate the road without incident, would you be willing to try their key?

TABLE OF CONTENTS

So Many Household Budgeting Systems

There are hundreds of people and organizations who have produced starter budgets, envelope systems, budget worksheets, online systems, and apps for managing money. It’s mind-boggling how many options there are. As we’ve spoken around the country, we’ve talked to many of the users of these systems. We’ve also heard one recurring theme, “We tried it, it worked for a while, but we aren’t doing it now.”

And the sad thing is, that most of these families, saw SUCCESS while they used their system. Why did they quit? Was it circumstances beyond their control? Maybe the road was too hard to navigate or the system too confusing? Was it taking too much time?

What is the key to household budgeting success?

. . . hold on, we’ll show you.

“Beware of little expenses.

Benjamin Franklin

A small leak will sink a great ship”

Old Ben was right, we need to pay attention to little leaks, small expenses before they get bigger. And caught early enough, a small leak can be repaired with a small patch.

The amazing key to our household budget success is budget tracking with a simple little paper booklet that most people rarely use today.

A Bank Register for Budget Tracking?

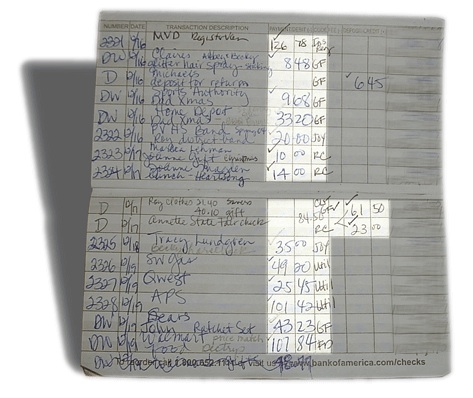

The secret to household budgeting success is in our checkbook registers. Okay, don’t give up on us yet! No kidding, this is a powerful tool, that can save you thousands of dollars every year if . . . you know how to use it.

We both carry checkbook registers. Annette carries the master register with our running account total, and Steve carries a “satellite” version. The secret is that we write down our expenses as we spend—the large and the small.

And we don’t spend much cash at all — cash has a way of evaporating without a trace. All of our expenses and deposits (debits, bill pay, auto pays, direct deposits, gifts and, others) are all written in our checkbook registers — it’s so simple and easy.

Just Trust Your Bank to Track Your Spending?

Some of our friends have said, “I don’t need to write things down, I just check my bank account online or on my phone to see what I’ve spent.” Between data breaches, overcharges, incorrect bank fees, or duplicate transactions, we find statement errors many times each year.

Even though we love our bank, we don’t blindly trust that the companies we purchase from or the digital banking system are flawless.

Writing down our transactions, saving receipts, and balancing our checkbook saves us hundreds of dollars each year.

Some people prefer to keep their receipts rather than record their transactions.

They file their receipts and review them at the end of the month while writing things in their checkbook or reconciling the receipts to their statement.

This isn’t terrible, but it can be fraught with problems because receipts can be lost, misfiled, not given by retailers, or become faded with time.

Should you Use Sinking Funds for Budget Tracking?

Some household budget experts advise that you have several bank accounts or “sinking funds” to keep your money segmented.

Each month money is transferred from the main bank account into other accounts for things like vacations; car payments, school tuition; daycare; mortgage, and anything else that you wouldn’t pay for with cash.

Yikes! How confusing and time-consuming would that be to have to balance or at least keep track of so many different bank accounts? We think there’s a better and simpler way.

Budget Tracking Tips to help you Succeed!

Following are 5 simple, yet amazing tips for using our budgeting system.

Tip 1) Keep Your Budget Tracking Simple!

We keep our budget system much simpler.

We have two bank accounts: One for our household budgeted expenses and then use a savings account for our Emergency Fund.

Our Main bank account is where our paychecks go and always has a balance of at least $4000. For our household budget, that bank account is subdivided on paper into 19 different budget categories (kind of like cash envelopes).

The Family Emergency Binder

Organize your family’s most important information – from finances to traditions to bedtime stories – so you’re prepared, no matter what happens.

The link below will take you to the EmergencyBinders.com website – an affiliate of MoneySmartFamily.com

Tip 2) Use Codes When You Track Your Budget.

The power and control of our household budget system gets even better.

Twice each month we have a budget staffing – where we combine the entries from Steve’s register into the master checkbook and then assign each expense a special two or three-letter code that corresponds with a category in our household budget system.

We have 19 categories in our budget—here are just a few of them:

- FD – Food for all grocery-related expenses

- MD – Medical for medical expenses, vitamins, herbs and such.

- MDI – Medical insurance – where we save and pay our monthly premium

- IMP – Impound account where we save for our semi-annual property taxes and annual homeowners insurance premium.

- UT – Utilities

- CL – Clothes

- RC – Recreation

The 19 categories in our household budget are actually sheets of paper that act like cash envelopes.

RELATED SAVINGS: GABI WILL HELP YOU SAVE MONEY: Quoting your Homeowners Insurance or Renters Insurance is a fast way to save money. We use GABI Insurance to get fast and easy comparison pricing. Just connect your current policy with their quote tool and you’ll be on your way to saving money.

Tip 3: Take recorded expenses out first

Each budget sheet has money deducted from it twice a month – based on the expenses labeled in the checkbook register. Then the individual budget accounts running total is recorded, and the total of all 19 budget categories equals the balance in the checking account.

Tip 4: Put the Paycheck Into the Budget with a Plan

The next step in our budgeting system is to take our paychecks and disburse money into the individual accounts – one-half of each month’s calculated budget is put onto each budget category sheet.

Here’s a Budgeting Example

Our food budget is $300 each month, so each pay period we deposit $150 onto the Food budget category (stewardship) sheet.

Auto Gas and Maintenance

We calculated our Auto: Gas and Maintenance budget account to be $250 per month, so each pay period we deposit $125. These amounts have been tested and averaged based on our spending over the years. In some accounts, we will accumulate excess for several months before spending on things like car maintenance or gifts. Other accounts are drained each month – like Medical Insurance and charitable giving.

Tip 5: Putting Money Back Into the Household Budget

Once the paycheck is disbursed onto our 19 individual budget account sheets, we total them all to ensure, once again, that the total in the budget matches the total in our checking account.

Tracking & Balancing Budgets Make us Smile!

When it balances, then we smile.

We smile knowing that our budget is balanced.

We smile because we know that we have money set aside for our semi-annual auto insurance; we’re saving for Christmas; we have money accumulating for medical expenses if needed and we have a little bit set aside for a date night.

Getting onto the road to budgeting success is a little like packing for a road trip. The more often you do it, the easier it is. And the better you plan, the more enjoyable the trip is.

The road to household budgeting success all starts with budget tracking, a simple little checkbook register, and using the 5 family budgeting tips we use to this day.

Learn more about the Household Budgeting System we use here.

For more information about budgeting, consider visiting our Pinterest Page and clicking on the Budgeting/Debt/Savings board.

In the next article of this budget series, we’ll share some of the incredible benefits and great results that our household has experienced from using our easy budgeting system. You’ll be amazed!