One of the pinnacles of financial stability and security is to Pay off your mortgage early. Owning your home free and clear may seem like a fantasy. But if you follow the 5 steps we took, it can be your reality too.

Some people pay their home off in 30 years, others 15. But there are a group of people who simply hate having a mortgage pay it off quicker.

We paid our home off in 9 years.

Our efforts to pay down our mortgage debt started with just one dollar extra each month . . . but quickly grew to much more. We used a budget and a mortgage calculator to track our progress. Use the calculator on the bottom of this page to get a vision for how much faster you can pay down your loan.

This page contains 2 Reader Questions, a Video, and a Mortgage Calculator:

1. How to Pay Off Mortgage Early

2. Video: How We Paid Our Home off in 9 Years

3. The Effects of Extra Payments on a Mortgage.

4. Mortgage & Extra Payment Calculator

TABLE OF CONTENTS

- 1 Question 1. How Did You Pay Off Your Mortgage Early?

- 2 An Early Mortgage Pay-Off is Achievable!

- 3 Watch this video where we describe the mortgage payoff process.

- 4 Calculating An Early Mortgage Payoff with Extra Payments

- 5 Question 2. How Do Extra Payments Affect My Mortgage?

- 6 Question #3 – How Do You Save a Down Payment on Poverty Wages?

Question 1. How Did You Pay Off Your Mortgage Early?

I’ve read in your books and in several interviews that you paid off your first home in 9 years on an average income of $35,000—and you had 5 kids! Could you explain how one would pay off your mortgage early?

Here’s how we paid off our mortgage faster — in only 9 years!

Paying off a home loan faster isn’t easy, but it isn’t super complicated either. It takes planning, focused attention and some discipline. We started simple and slow and built from there.

There are five things we did to pay off our house quickly.

- Save a Larger Downpayment;

- Buy Smaller

- Have a Spending Plan

- Hate Debt

- We communicated with our mortgage holder.

Our first home was a 1458 square foot repo. We purchased it from the bank and got a favorable home loan rate of 11% (the going rate at that time was 13%. We were able to pay off our mortgage faster using the 5 tips in this article.

1) Pay off your Mortgage Early by Saving a Larger Down Payment

Years ago, when borrowed money was easier to get, down payments could be lower or non-existent. Even today, FHA homes only require a minimum of 5% down.

At the time we purchased our first home we were earning about $20,000 per year and had managed to save enough to put a 15% down payment on the house. The larger down payment meant that we’d have a smaller monthly payment because we borrowed less.

2) Accelerate Your Payoff By Buying a Smaller Home

We bought a small (1,458-square-foot) repossessed house and financed less than the bank said we could borrow. Many people think that buying a bigger house is better. Larger houses cost more to heat, cool, insure and maintain, and you pay more in property taxes.

Don’t buy a larger house to impress your friends and family — they aren’t the ones who will lie awake at night worrying about making the payment, or have to pay the higher utility bills or maintenance costs. Thinking small helped keep our mortgage payment manageable and allowed us to pay extra each month. As a result, we were able to retire our mortgage debt very quickly.

3) Manage Your Mortgage By Using a Written Budget

Having a way to control your saving and spending is the key to reaching your financial goals. Our budget allowed us to save in advance of all anticipated expenses. It also revealed when we had extra money, which we used to pay off our home faster.

Our first additional principle payment was only $1 extra on our mortgage. The next month it was more, and then as our income increased, so did the amount we paid of extra principle we paid on the mortgage.

But the key to paying extra was that we had a great budgeting system (that we still use today) that let us know whenever we had extra money and how much extra we could afford to pay on the loan.

RELATED SAVINGS: GABI WILL HELP YOU SAVE MONEY: Quoting your Homeowners Insurance or Renters Insurance is a fast way to save money. We use GABI Insurance to get fast and easy comparison pricing. Just connect your current policy with their quote tool and you’ll be on your way to saving money.

4) Pay Off Your Mortgage Early by Hating Debt

We avoid debt like the plague. It’s an attitude we both share. If someone tries to entice us to make a purchase with credit, we simply walk away.

We are so addicted to living within our means that the lure of buying now and paying later is very unattractive. So paying off our home was more of a priority to us than buying new cars or taking fancy vacations.

We bought gently used cars when needed and took enjoyable annual vacations, spending only the money we had saved for that specific purpose. By avoiding debt, we were able to keep our monthly expenses lower and raise the amount we paid off on the house each month.

Our book, America’s Cheapest Family Gets You Right on the Money describes many ways that we have found to get better quality items for much less than retail!

As we watched our mortgage’s principal balance plummet, we experienced a feeling of euphoria. This led us to find more ways to save money on other expenses such as groceries, home repairs, clothing, and car insurance, so we could put more on the house and pay it off as quickly as possible

5) The Day We Finally Paid Off our Mortgage

The day we made the final payment was memorable indeed. We had called the mortgage company the week before and told them the date that we intended to make the final payment. They sent us the final mortgage pay-off amount and we mailed them the check. You can’t imagine the feeling of accomplishment and relief at reaching that milestone! It was electric!!!!

By the way, make sure that you request a paid in full document / zero balance receipt. A month later we received a release of the deed of trust from our County Recorder that served as proof of ownership and that our mortgage was completely and finally paid off!

An Early Mortgage Pay-Off is Achievable!

You can see that paying off a home loan early isn’t rocket science, but it does take some careful planning and a commitment to a long-term goal. If you follow these five steps you’ll be on your way to accomplishing a financial feat that many people don’t even consider. Paying off your mortgage early will set you on the path to financial security!

Give it a try — it’s fantastic!

Watch this video where we describe the mortgage payoff process.

In this video, we share with Gary Foreman from Stretcher.com many of the tactics we used to pay off our mortgage in 9 years.

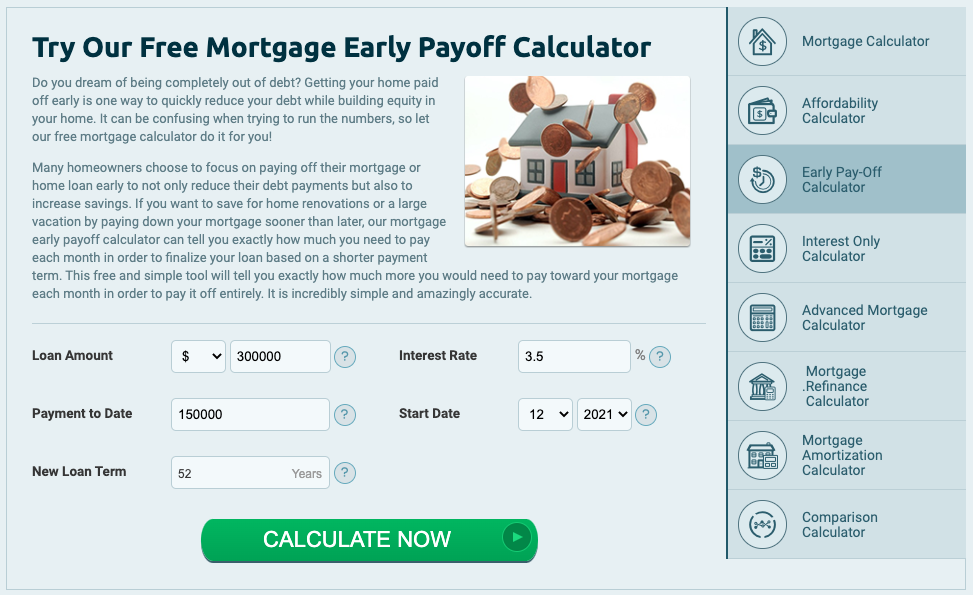

Calculating An Early Mortgage Payoff with Extra Payments

There are several different calculators for you to try. One will produce a straight mortgage amortization schedule and calculate your payment. Another one will show you how extra principal payments affect the long-term outcome of your mortgage.

Keep reading and try the calculators on MortgageCalculator.net – click on the image below to be taken to MortageCalculator.net.

Question 2. How Do Extra Payments Affect My Mortgage?

I like to know more about mortgage payments. I have a 30-year note if I pay one or two extra payments each year, how much faster will I pay off my home?

Answer: How to Calculate the Effects of Making Extra Mortgage Payments

There are several websites that have developed mortgage calculators where you can punch in your numbers: Interest, Principal Balance, Number of years left to determine the effects of extra mortgage payments.

- BankRate.com – they have lots of different calculators

- If you want to see how extra payments affect your mortgage balance try the calculator in the next section.

Both websites have several different calculators you can use to determine the best course of action. In general terms, every extra principal payment eliminates more than just one payment from your mortgage. The reason is that each payment consists of a certain amount of Principal (what you owe on your home); Interest (what you’re paying the lender for borrowing their money; Taxes (property taxes); Insurance (homeowners insurance) and sometimes MIP (mortgage insurance protection).

For example A $150,000 loan at 5% interest and a 30-year payoff.

Extra Payments During the First Few Years

In the early years of a home loan, a $985 monthly payment could consist of:

- Principal: $180

- Interest $625

- Property Tax: $100

- Insurance: $80

By making an extra principal payment of $985 you don’t eliminate just one payment from your amortization schedule, but approximately 5 principal payments of $180 or more from the amortization schedule. Maybe this table will make it more understandable.

| Payment # | DATE | PRINCIPAL | INTEREST | PAYMENT | BALANCE |

|---|---|---|---|---|---|

| 1 | 9/17/2021 | $180.23 | $625.00 | $805.23 | $149,819.77 |

| 2 | 10/17/2021 | $180.98 | $624.25 | $805.23 | $149,638.79 |

| 3 | 11/17/2021 | $181.74 | $623.49 | $805.23 | $149,457.05 |

| 4 | 12/17/2021 | $182.49 | $622.74 | $805.23 | $149,274.56 |

| 5 | 1/17/2022 | $183.25 | $621.98 | $805.23 | $149,091.31 |

| 6 | 2/17/2022 | $184.02 | $621.21 | $805.23 | $148,907.29 |

| 7 | 3/17/2022 | $184.78 | $620.45 | $805.23 | $148,722.51 |

| 8 | 4/17/2022 | $185.55 | $619.68 | $805.23 | $148,536.96 |

As you get further along the amortization schedule of your loan, the principal amount that you are paying increases, and the interest amount decreases. So the fastest way to pay off your home is to pay extra on those early payments.

Whenever you make an extra principal payment, be sure to let the mortgage company know that what you’ve paid is to be applied to the principal. Some companies we worked with applied extra payments to prepaid interest! Also, always ask for a loan history report each year to check that your extra payments have been properly credited to your account.

Run the Loan Numbers Yourself

Try this calculator below, you can plug in extra payments and see the actual numbers for yourself. If you get started on this early payoff track, pretty soon you’ll be as addicted to killing debt as we were! And you will be able to pay off your mortgage early.

Question #3 – How Do You Save a Down Payment on Poverty Wages?

Even though we touched on this above, there are several things you can do to gather a down payment.

- Make sure you are working on improving your credit score if this is an issue read this article.

- Try hard to pay down your debt. You can do that in 2 ways, one is by earning more money, and two is by saving more money. We have several pages that talk about this in the money-saving tips section of our website, under the budgeting icon.

- Make sure you have a budgeting system to track what you are spending on everything, so you know where your money is going!

- Some cities have incentives and discounts, and even grants for first-time home buyers, do a web search for those where you live.

It’s not impossible to own a home, but it does take some planning. Hang in there, the effort and sacrifice are worth the prize of homeownership.

For more ideas about frugal living, visit our Pinterest Page and click on the Budget/Debt/Savings board.

If you have any tips to share on how to pay off your mortgage early please leave them below in the comments section.